Everyone remembers the moment in a car purchase when the salesman reaches into a desk drawer, produces his used car value guide, riffles pages for a minute and then names a price for your trade-in with an air of unimpeachable authority.

The book is his key tool, and he isn’t keen to share its contents.

Where do these prices come from? And given that they govern so much about a deal, how do we know they’re accurate? How can a price guide forecast a new model’s secondhand value, as some do?

Having so often been a customer in the car selling game, I decided to investigate the other side of the business by accepting an invitation to join Rupert Pontin, new head of valuations at Glass’s Guide, oldest and best known of the UK’s guides, first at his offices in leafy Byfleet on London’s south-western outskirts and then at a car auction.

Pontin has been in the game for 30 years, managing fleets and leasing firms, selling cars and most recently launching successful digital versions of Glass’s price guide and forecasting tool. We gather in the boardroom, where it soon becomes clear that, for all the science and statistical theory the business nowadays collects, old-fashioned industry ‘nous’ remains all-important.

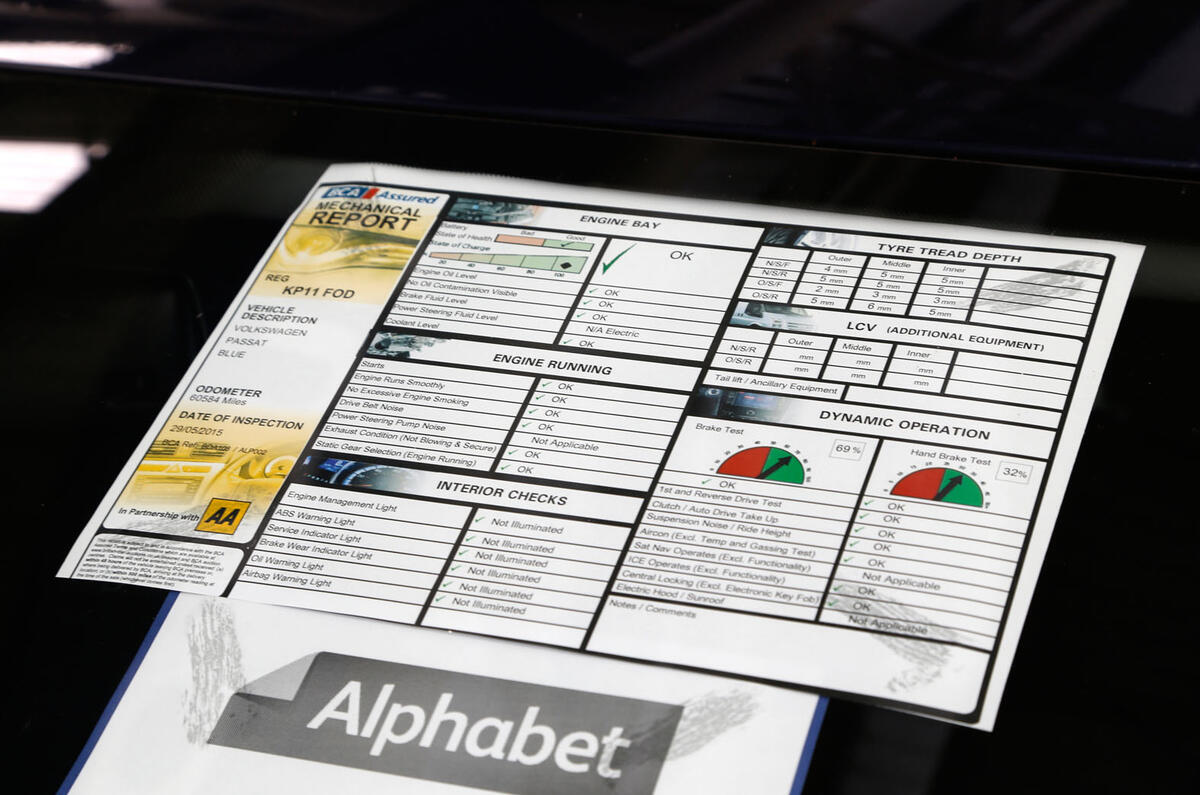

Used car price movements are a classic chicken-and-egg situation. Latest book prices depend heavily on recent auction sales (fed in bulk to Glass’s specialists by auction firms), which in turn have been affected by previous book prices. For a moment the whole thing sounds predictable, but every expert insists that the market is capricious in the extreme, and every one of them has a rich selection of stories about surprises.

Book prices usually change monthly, affected both by factors such as supply, demand and fashion and by tiny adjustments Glass’s experts make to take account of changing market conditions.

“We have 12 years’ market analysis of cars’ pricing over their lifecycles,” says Pontin, “plus a decade of data about how prices are affected by background inflation. Throw in our knowledge of the seasonality of prices and the effect of new registration plates, then factor in the state of the background economy, and you see why price movements result from complex calculations.”

How reliably can you predict residual values up to three years ahead? There’s no mystery, insists Pontin. “You start from a firm foundation,” he says, “by learning as much about a new car as you can. We knew all about the Jaguar XE many months before it hit the market. Then you take account of the price behaviour of predecessors and competitor vehicles and add your own impressions of how it compares. Do it right and you won’t be far away.”

Join the debate

Add your comment

LP plays right tune

Fleet managers

Glasses Guide at times, is so far out, its ridiculous. Many times, seen cars on Auto trader, selling for less then book price. You only get what someone is willing to pay. Condition is not always king.

Fleet managers

Glasses Guide at times, is so far out, its ridiculous. Many times, seen cars on Auto trader, selling for less then book price. You only get what someone is willing to pay. Condition is not always king.