According to the poker-related clicheÃ, you can learn a lot about people by how they behave when the chips are down – and the car industry has demonstrated that in the most literal of ways this year.

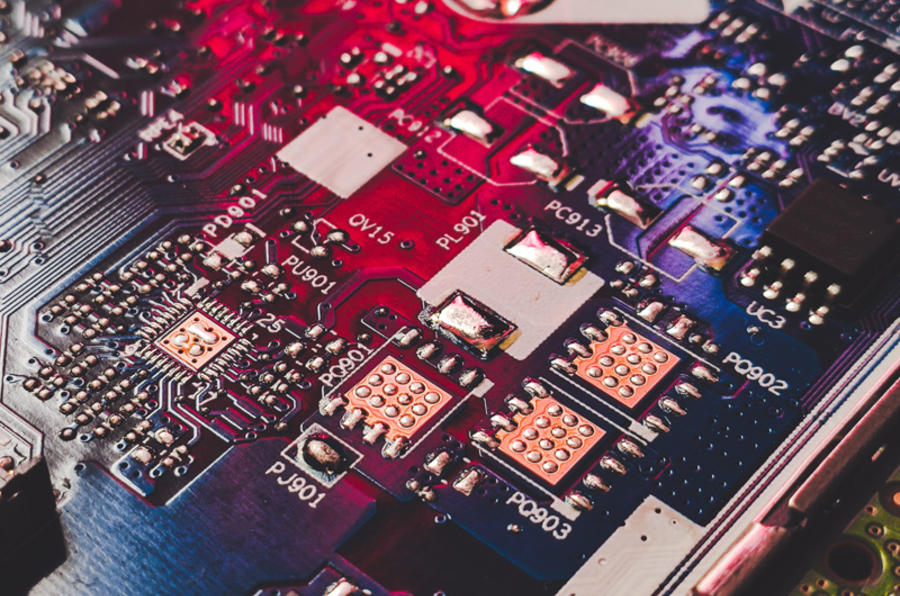

An ongoing global shortage of semiconductors means processing chip production is down, which has had a seismic impact on the car industry. With most cars now packed with chips to power new technology, many firms have been forced to slow or suspend production, creating a shortage of cars for customers to buy. The biggest news story of 2021 is a perfect storm of disruption at a time when the industry is undergoing unprecedented change and still trying to recover from the huge impact of the Covid-19 pandemic.

Why the industry can't have its chips:

The origins of the semiconductor shortage lie in the early days of the pandemic in 2020. Modern cars are using increasing numbers of semiconductors due to the increasing amount of on-board technology: they power infotainment systems, driver assistance technologies, in-car features, electronic battery management and more. But as firms suspended production due to Covid lockdowns, they cancelled parts orders from suppliers – including from semiconductor manufacturers.

Semiconductors are widely used in electronic devices such as computers and games consoles, sales of which surged during lockdown. So the electronics firms kept their orders for chips in, and when they began production, the car firms discovered they had dropped to the back of the queue. And that queue is getting longer: according to the Semiconductor Industry Association, sales of semiconductors were up 26% year on year in May this year.

It’s a basic supply and demand problem, but one without an easy solution: it isn’t feasible to simply ramp up production of the chips. Semiconductor fabrication facilities – known as fabs – are incredibly complex to set up. The production processinvolvesaround1400steps andrequiresspecialisttoolsand skills. According to tech website Venturebeat, building a new fab can cost £9 billion and takes three years to become production ready.

How the car industry is reacting

With no easy answer on the production side, the car industry has been left with a range of unenviable solutions. Many firms have been forced to produce cars without chips (adding them in later) or even scale back production, a somewhat unpalatable option given that shuttered factories themselves run up substantial costs.

Add your comment