The software issues that have hampered the build-up to the launches of Volkswagen’s new ID 3 EV and eighth-generation Volkswagen Golf demonstrate how important such systems are to modern cars – and how complicated they have become.

The software required for the previous Golf contained around one million lines of code – compared with 10 million for the ID 3. For companies traditionally focused purely on building the mechanical elements of cars, that increasing need for software presents a dilemma: do they buy in the new software that’s needed or make it themselves?

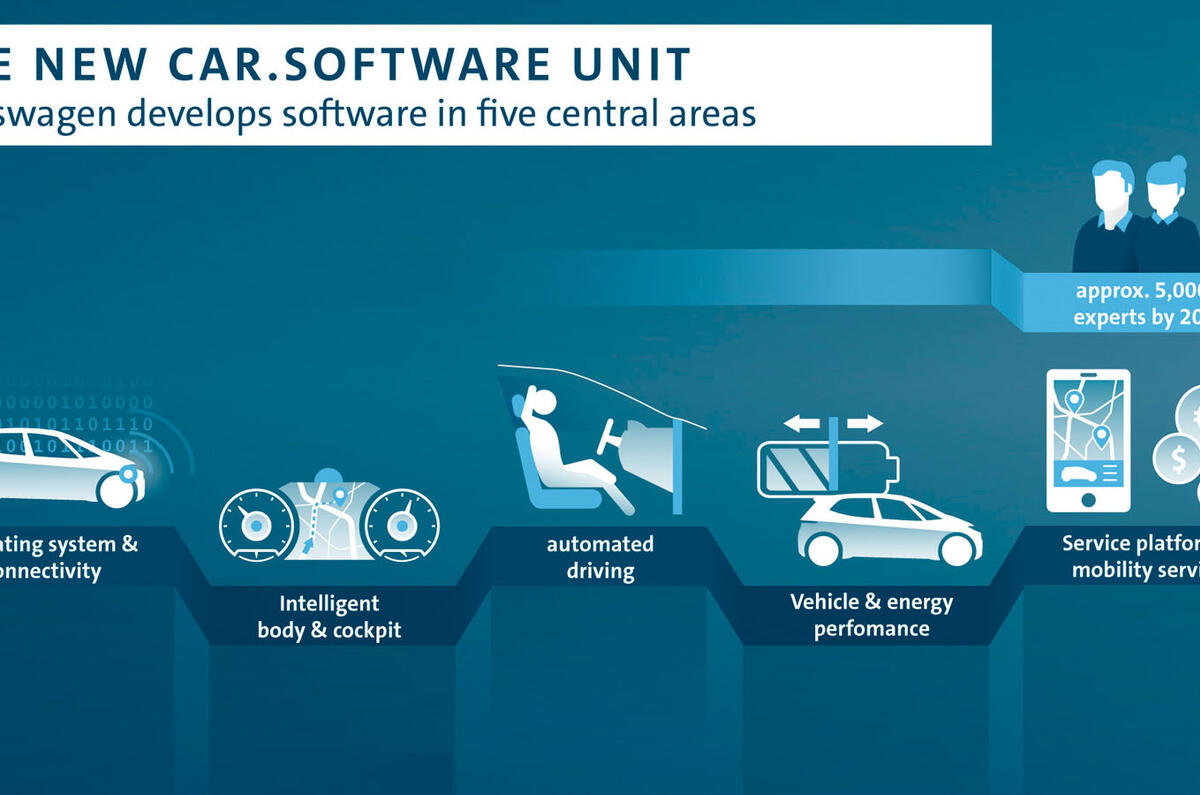

The Volkswagen Group has bet heavily on the latter, creating the new Car.Software unit, which officially becomes fully operational today. Headed by Christian Senger, who was previously in charge of the firm’s ID models, by the end of this year it will encompass 5000 staff gathered from various Volkswagen Group brands. By 2025, it plans to employ more than 10,000 staff worldwide – half of them in Europe, around a third in China and the rest in the US, Israel and India.

The Volkswagen Group’s goal is to raise the proportion of its cars’ software produced in-house from less than 10% currently to 60% by 2025. Senger said the easy path would be to focus on vehicle production and use the group’s scale to negotiate competitive supply deals with software providers, especially tech firms that are working on their own automotive operating systems, such as Apple and Google. But that was “out of the question” for three key reasons.

The first is manufacturing experience, which Senger said differentiates the group from “competitors outside the industry”. The second is the firm’s desire to “retain control of the entire vehicle architecture”. Senger said this is “the only way to ensure longterm competitiveness”.

Join the debate

Add your comment

Das cheat software

So

Do you have any news from any manufacturers apart from VAG. It's not surprising given that the company sat it's "smug ass self" on diesels that were never gonna work correctly since you couldn't be bothered to engineer that either.

Great article

Surprisingly excellent article, insightful interview. I'm sure there is more to this than VW is admitting at this time. I'd like to know more about what the 10,000 staff will be working on. I'd bet there are some fascinating projects on new revenue streams through both in-car services and data sales to third parties.