Political tension between China and the UK has started to affect industrial investment in the UK – the Huawei 5G furore, nuclear power projects and the HS2 railway line being some of the higher-profile examples.

But how will this tension affect China’s car industry investments in the UK, led by Geely, SAIC and Nio? At stake are thousands of jobs and billions of pounds of investment in UK facilities.

“It’s definitely a concern,” said Professor David Bailey of Birmingham Business School. “Government has a new relationship with China and the big question mark is, even if these investments are private Chinese companies, they operate in a country where the state is much more active in day-to-day operations.”

The biggest Chinese investor in the UK is Geely, an industry newcomer that started selling cars in 1997 yet expanded rapidly by buying ‘distressed’ overseas companies: Volvo in 2010 for $2 billion (£1.5bn), Manganese Bronze Holdings (the London taxi maker) in 2013 and Proton and Lotus in 2017. Geely’s decade of ownership of Volvo has been textbook, bolstered by around £8.5bn of investment and delivering a convincing impression of long-term strategy.

In the UK, Geely has more than 2000 employees and a financial commitment put at £1.0bn to £1.5bn, with plenty more to come, especially as Lotus accelerates into its Vision80 plan, which should lift production to more than 5000 cars per year by 2028.

A Geely spokesman said the company is firmly established in the UK and is sticking with its agreed business plans for all UK companies: “Geely Holding remains committed to its operations, ongoing business investments and market presence the UK, where its strategy is unchanged.”

Like other car firms Autocar contacted, Geely declined to discuss the geopolitical situation at government level. But Autocar understands from industry sources that there is unease at a high level that further deterioration in the relationship could spill over into the automotive sector.

Car making doesn’t have the same security implications as a China-supplied 5G network, but it’s vulnerable to trade disputes, because it’s a high-value, high-profile business. The Society of Motor Manufacturers and Traders (SMMT) recognises a “concern when there are global trade tensions” but says: “Trade and investment between both countries is helping to grow our respective economies.”

In June 2019, the SMMT signed a co-operation agreement with its Chinese counterpart, the CAAM, that could develop into a vital communication channel to dampen hawkish rhetoric. “We hope this agreement bolsters relationships, manages issues and opens up new opportunities in both markets,” said SMMT boss Mike Hawes. The SMMT initiative might go some way to levelling the Chinese dominance in some vital areas of technology, too.

China has become the sole global source of some rare metals for lithium ion battery anodes and cathodes and components such as insulated-gate bipolar transistor switches – vital parts for any battery electric vehicle (BEV).

Time has moved on since SAIC pursued MG Rover in 2004, but the unseemly end to Britain’s last volume car maker, with Nanjing and SAIC squabbling over the remains of MG, asset-stripping its factories and subsequent on-and-off commitment to UK engineering and production, also illustrates how Chinese automotive strategy can be less than coherent.

Today, MG has reduced its engineering at Longbridge to a bare minimum, sold off the remaining land for housing and concentrated on a slimmed sales operation in London. However, new MG models show how Chinese production can translate into good-value family motoring for UK drivers.

Although the transfer of UK technical know-how to China is often flagged as a concern, the UK also stands to benefit from Chinese BEV battery technology. At least five of the world’s biggest battery cell manufacturers are Chinese. The £2m Lotus Evija hypercar, for example, will benefit from Chinese BEV technology.

Another little-known aspect of the UK-Chinese motor industry is the growing ownership of and investment in UK automotive technology start-ups by Chinese firms. Richard Gane, automotive management consultant at Vendigital, has tracked the Chinese acquisition of several British tier one and tier two suppliers. Some are high-tech, like Protean Electric, a maker of in-wheel hub motors by NEVS, the Chinese company that bought Saab and is ultimately controlled by Evergrande, a Chinese property firm that also recently bought American BEV maker Faraday Future.

Midlands-based pressing companies Covpress and UYT have been bought by Yongtai Chemical Group. The UK government’s trade department can’t supply financial figures for Chinese automotive inward investment into the UK, but independent estimates seen by Autocar suggest a figure of around £500m per year and growing.

The trade department does list the number of Chinese investment transactions, which average about 100 per year, the bulk of which, Autocar understands, are of small monetary value in technology companies, many thought to be making BEV components.

“Chinese investment can be a very good thing for automotive technology companies,” said Gane, “but we have to be careful that we don’t hollow out this emerging, new supply chain, resulting in very few tier one suppliers remaining British-controlled.”

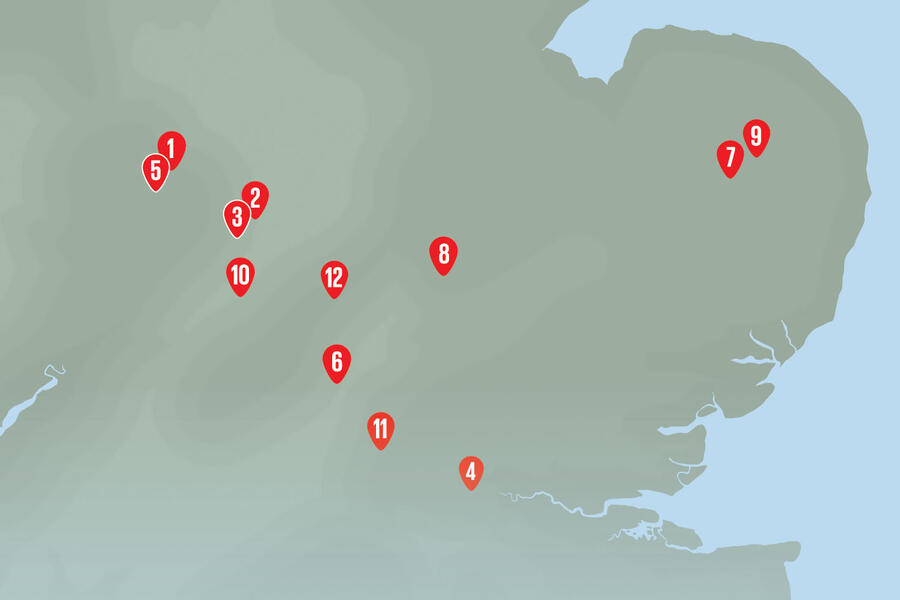

The 12 UK bases backed by Chinese firms

1. Changan UK R&D Centre - Birmingham Engine and transmission design, research and development. Employs 200 people

2. LEVC - Ansty, Coventry HQ, engineering and taxi and van manufacture. Production capacity: 20k/yr. Employs 550 people

3. Geely Design - Coventry Advanced and production car design. Employs 100 people

4. MG Motor UK (SAIC) - Marylebone HQ, sales, aftersales and advanced design. Employs 100 people

5. SAIC Motor Technical Centre - Longbridge, Birmingham Engineering. Employs 50 people

6. Nio UK Advanced Engineering Centre - Beabroke Science Park, Oxford Advanced concept engineering and CAE crash testing. Employs 45 people

7. Lotus - Hethel HQ, engineering, design and car manufacture. Production capacity: 5k/yr. Employs 1150 people

8. Lotus - Wellingborough Anodising alloy structures. Employs 50 people

9. Lotus - Norwich Chassis, fabrication and aftersales. Employs 130 people

10. Lotus Engineering - Wellesbourne Concept, powertrain and design/production engineering. Employs 130 people

11 Volvo Car UK - Maidenhead HQ, sales, marketing and aftersales. UK sales in 2019: 56,208. Employs 160 people

12 Volvo Car UK - Daventry Training and development centre. Employs 40 people

Q&A: Hui Zhang, VP, Nio Europe

Why did Nio select the UK for an engineering centre?

“There were two reasons. We have strong connection to England that links back to our sadly missed co-founder, Martin Leach. The other is the very long automotive tradition in the UK.”

And why Oxford?

“It was chosen specifically for the access to extremely skilled engineers. Additionally, there’s a lot of momentum in Oxford for EVs.”

Do current government tensions concern Nio?

“We’ve always kept out of politics. But we see the benefits that global trade brings, and a strong economic co-operation is in all our interests.”

How much investment has Nio committed to the UK?

“We’re seeing the fruits of our investments, which have been very significant over the years. And we have achieved a positive margin on our products for the first time this quarter.”

What about UK sales of Nio electric SUVs?

“We were targeting sales outside of China this year but, due to Covid-19, we have had to postpone. It will take another two years to achieve. A launch in select European countries hasn’t been fixed but is coming. An analysis of which markets has been under way for some time.”

READ MORE

How China is fuelling Volkswagen's electric dream​

Bringing premium EVs to China: Behind the scenes at Nio

Will China's dwindling car market bounce back?​

Join the debate

Add your comment

Great points

So many scenarios...

I do think however, relience on others (near and far), is risky at the moment not helped by a certain leader across the pond.

I'll stop there as I'm out of my depth.

At some point in time the UK

At some point in time the UK might learn the industial strategy lesson that you should invest in your own country and not trawl the world looking for others to do it for you, then wondering why every diplomatic tension causes a potential crisis, or the profits go back to the home nation.

But investing in your own

My late father told me about

My late father told me about how people laughed at the silly little Japanese cars when they first came to the UK along with their silly little motorcycles. No one is laughing now. I suspect that the Chinese and their cars will soon inhabit a large part of the car market over here in the next 5 to 10 years too. I dont think we will hear as much laughter this time around as we did when the Japanese first came here...

In some respects,...

...they are already here! Some argued that MG vehicles are just rebadged products from their Chinese home market. Not saying that is a bad thing, but how long will it be before other brands are selling Chinese vehicles with the names and styling of local name plates? While Japanese and Korean makers came selling their stuff, styled to appeal to your tastes, the Chinese are attempting to sell their product dressed in your clothes. By buying struggling brands and investing in upstarts, their products (or items that contain their products) maybe closer then you think and may already be here. Which may be for the better, if politics don't get in the way and make for the worst.

Yes, but...

Whilst I don't fundamentally disagree that this could be a repeat of the Japanese and Koreans I am reminded of a Top Gear piece (2012?) when they roadtested a Roewe 350 with a positive response and expected the Chinese to grab a big UK share in a handful of years. It didn't happen and subsequently Great Wall came and went while we never saw Qoros or Borgward. The European market is difficult to crack (Geely/Volvo notwithstanding) and may not be worth it compared to expanding Third World markets. In their home market the Chinese are coming up with some futuristic designs/technology but they have struggled through having so many car brands - still not sure how they manage to build factories and tool up with such low build volumes. However, Chinese labour rates continue to increase and countries like Indonesia and Vietnam are actually now more competitive so there is a risk that in the long term they may lose out.