The motoring industry has reacted in a mixed manner to the changes to road tax, MOTs and insurance announced in the 2015 Budget.

Vehicle Excise Duty (VED) is set for the biggest overhaul, as the current road tax system is being largely scrapped from 2017. It will be replaced a three-band system where cars will be classified as Zero Emission, Standard and Premium. Only cars that emit 0g/km - only electric vehicles for now - will pay nothing, while all other cars will pay £140.

The exception is cars that cost more than £40,000, which will be subject to an extra £310 charge, meaning many cars will face a £450 annual road tax payment. This applies even to cars that emit 0g/km, such as the Tesla Model S, which will have a £310 tax bill.

There are still 13 bands for the first year of a car’s life, with those that emit less CO2 paying less tax. Cars emitting 1-50g/km will pay just £10, while those that emit more than 255g/km will pay £2000.

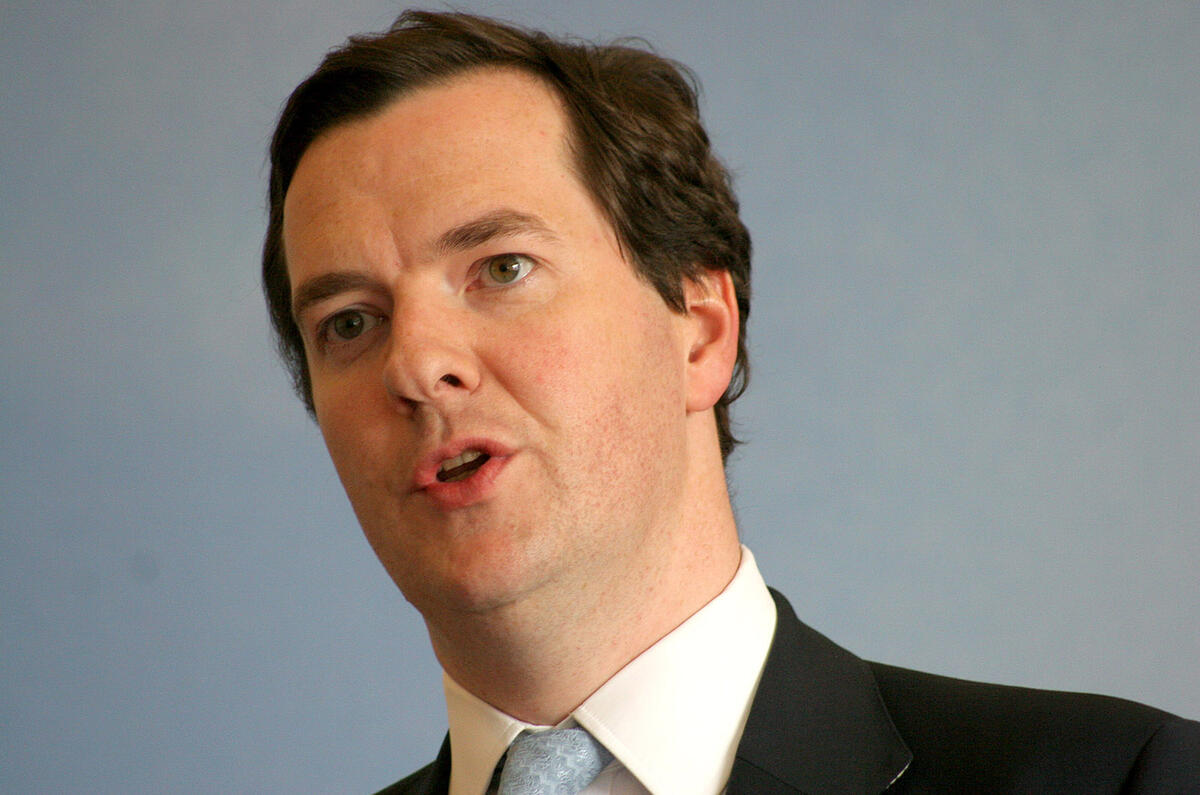

Addressing Parliament, chancellor George Osborne said the current VED system “isn’t sustainable or fair”, given the rise in low-emissions vehicle ownership, which has resulted in increasing numbers of people paying no VED at all during their first year of ownership. He revealed that the system will be reviewed as necessary to make sure the cleanest vehicles are incentivised.

However, the Society of Motor Manufacturers and Traders (SMMT) has expressed concern that the industry wasn't consulted on the plan.

SMMT chief executive Mike Hawes said, "The chancellor’s Budget announcement on the regime came as a surprise and is of considerable concern. While we are pleased that zero-emissions cars will, on the whole, remain exempt from VED, the new regime will disincentivise the take-up of low-emissions vehicles. New technologies such as plug-in hybrid, the fastest-growing ultra-low emissions vehicle segment, will not benefit from long-term VED incentives, threatening the ability of the UK and the UK automotive sector to meet ever-stricter CO2 targets.

“The introduction of a surcharge on premium cars also risks undermining growth in UK manufacturing and exports. British-built premium cars are in increasing demand at home and globally, and the industry helps to support almost 800,000 jobs in the UK. Levelling a punitive tax on these vehicles will almost certainly impact domestic demand.”

Figures from the SMMT reveal that demand for low-emissions vehicles is helping to drive growth in the UK's new car market. In June 11,842 ultra-low-emissions vehicles were registered in the UK - a four-fold increase on the same period in 2014.

Join the debate

Add your comment

Please sign this petition and force the Government to change

Please sign this petition and force the Government to simply move the VED CO2 bandings down, continuing to incentivise buyers to look at ever more efficient cars.

https://petition.parliament.uk/petitions/122202

Please sign this petition

Please sign this petition and force the Government to simply move the VED CO2 bandings down, continuing to incentivise buyers to look at ever more efficient cars.

https://petition.parliament.uk/petitions/122202

Fair