One statistic jumped out of the UK automotive manufacturing figures for June. The number of cars built in the country for sale here, rather than for export, fell by 47%. Have we really fallen out of love with UK-built cars that much?

The answer is tied up in a rollercoaster half year for car sales in this country.

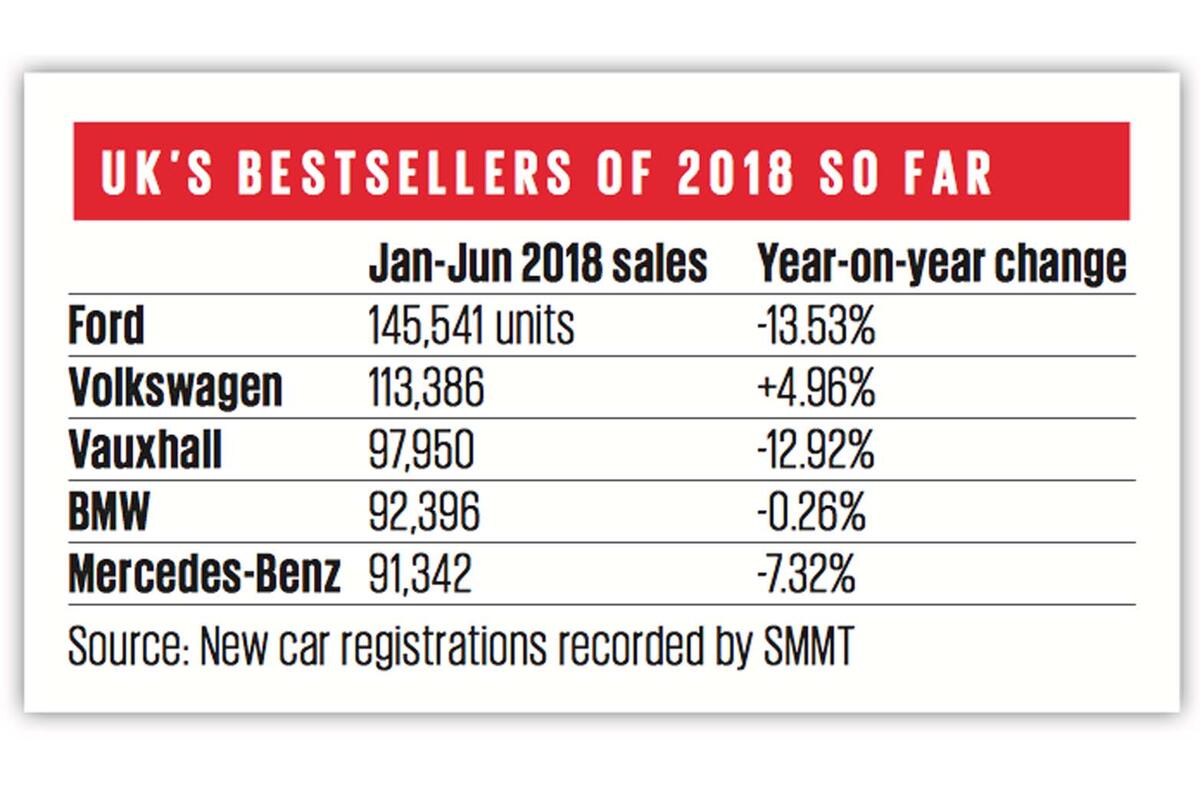

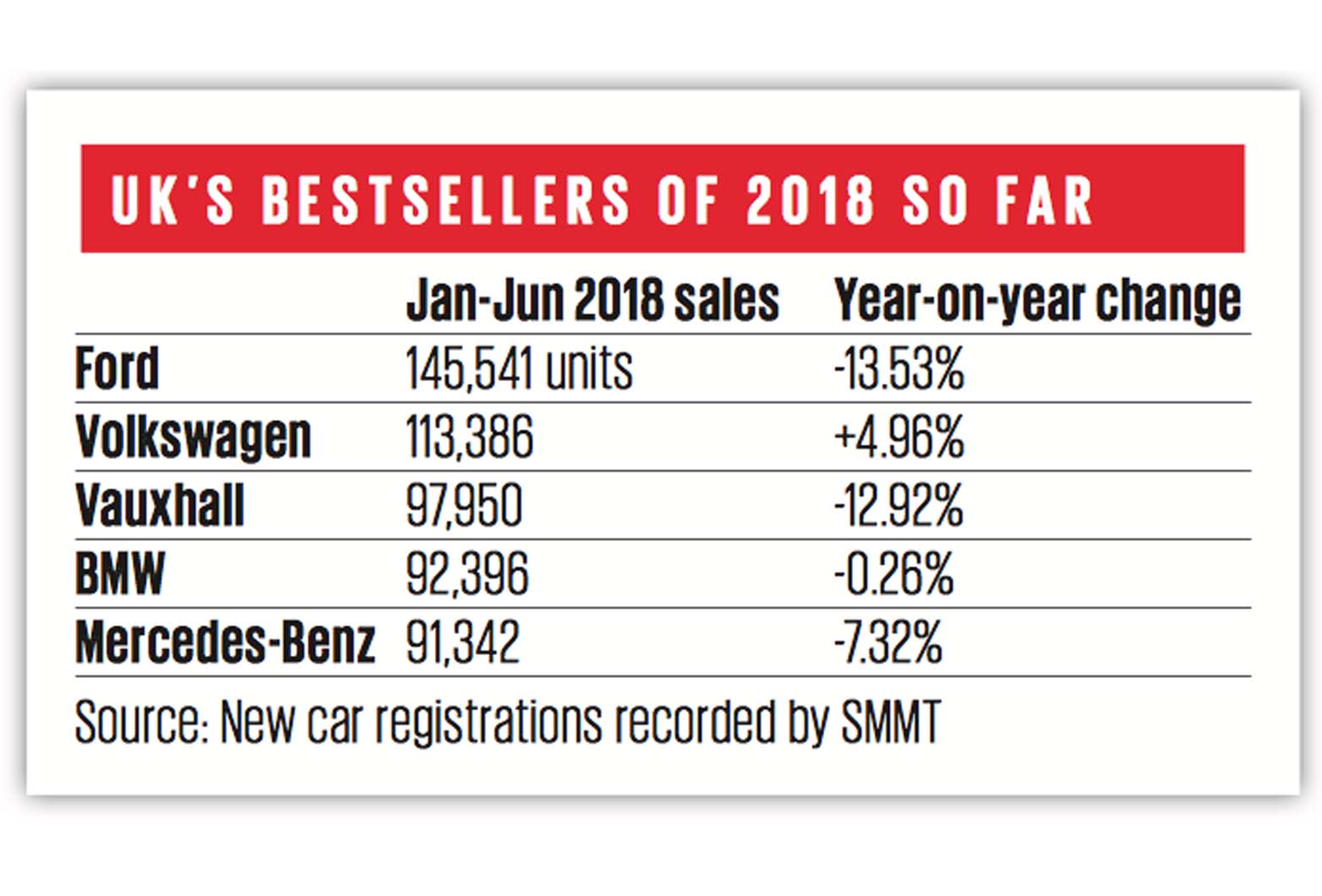

“I’ve been in the industry 26-27 years and I can’t recall a year with so much distortion,” said Daksh Gupta, chief executive of the Marshall Motor Group, which has 99 dealers in the UK. On the surface, UK car sales are holding up pretty well considering the disruptive forces of Brexit, a weak pound and the flight from diesel. The numbers for January-June this year were down 6.3% to 1.3 million, according to the Society of Motor Manufacturers and Traders (SMMT).

But behind the relative calm of the sales figures is turmoil. Diesel sales are tanking. In the first six months, the UK public bought nearly 200,000 fewer new diesel cars than in the same period last year, giving new diesel cars a market share of just 33%.

Some car makers are suffering more than others and the key ones have British manufacturing plants. Jaguar Land Rover’s first-half UK sales were down 9%, for which it largely blames the diesel decline; 85% of its UK sales are diesel.

Nissan’s sales were down 30%, with demand for the Nissan Qashqai SUV — the car with the highest manufacturing volume in the UK — falling 25%. Nothing mysterious about that; the Qashqai is getting too old to really compete in a red-hot segment, as is the Nissan Juke (also built in Sunderland) and the Range Rover Evoque.

The number of cars approaching the end of their model cycle is a big reason for the June manufacturing decline. “They’re facing tougher competition and the impact is big enough to offset the gains posted by newer UK-built cars such as the Range Rover Velar and Land Rover Discovery,” said Felipe Munoz, global analyst for market researcher JATO Dynamics.

The fall in diesel sales is affecting all premium brands. “Every year I’ve been in the industry, the premium brands are always up. This is the first year they’ve underperformed,” said Gupta. While sales to private customers fell 4.9% overall in the first half, premium sales dropped 7.9%.

Sales of used diesels rise despite overall decline in second-hand car market

Prior to the Brexit vote, one analyst coined the phrase 'treasure island' to describe the richness of the UK to car manufacturers. A strong pound and buoyant economy meant the UK was targeted by car makers; Ford said in July that “most” of the $1.2 billion (£992 million) profit made in Europe in 2016 came from the UK.

Join the debate

Add your comment

Things change. Welcome to the

Things change. Welcome to the real world.

Perfect storm

It should be no surprise that car manufacturing has fallen in the UK, given the uncertainty caused by Brexit and the massive impact and confusion regarding WLTP. Manufacturers have been forced to stop production of vehicles that may not meet the new requirements coming in to effect on Sept 1st. Company car users are being put off from renewing their company cars due to increased taxation of the new Co2 emissions and are extending existing contracts or opting out and buying used. Whilst one can excuse the Government for being distracted by all the other impacts of Brexit, they appear to have totally underestimated the devastating effect on the UK car market of the increased and punitive taxation now facing company car drivers.

The dominance of VW

The VW group is just getting bigger & bigger; & thats shows in the UK car market.

Just read an article that VW plans to up production in Wolfsburg to over ONE MILLION units a year. And that's just in one plant in Germany, combined with the other German plants plus the rest of the VW group (Audi,Seat,Skoda & Bently,Porsche....) their operations will be so cost efficient that nobody else will be able to compete with 'em. GM recently pulled out of Europe (Opel/Vauxhall sold to PSA), because it couldn't compete, & now Ford is even contemplating withdrawing from Europe because of losses.