The PSA Group, including Peugeot, Citroën and DS, will launch seven plug-in hybrids and four electric vehicles as part of its growth plan, as well as implementing a connected and autonomous vehicle programme.

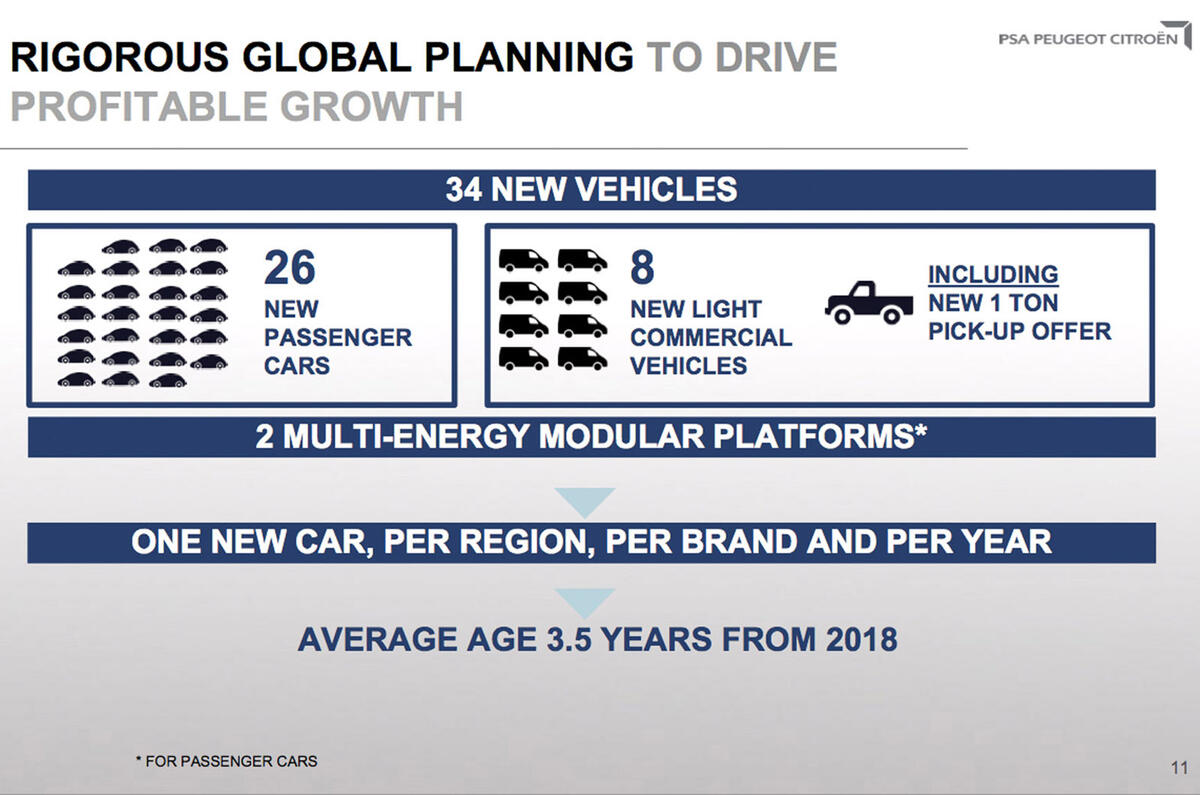

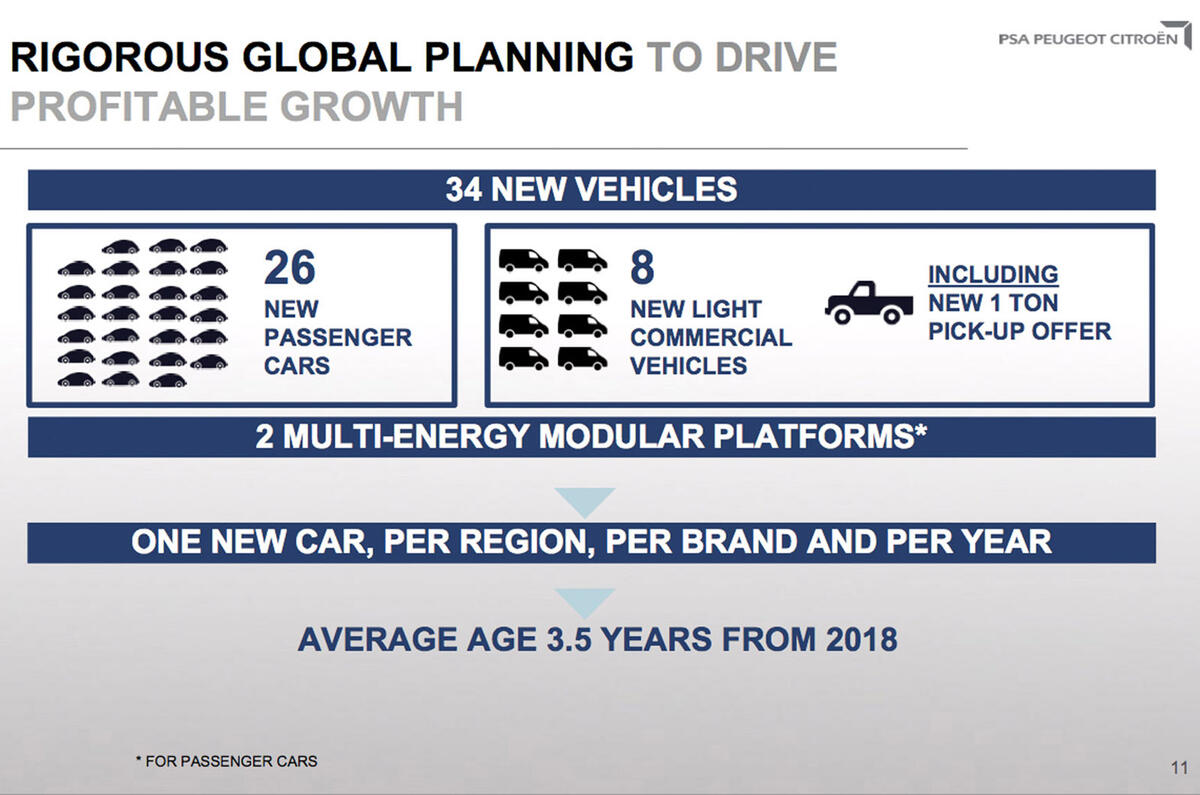

More broadly, the company will introduce a 'product blitz' across Peugeot, Citroën and DS brands, launching one new car, per region, per brand, per year. This will include 26 passenger cars and eight light commercial vehicles, including a one-tonne pick-up, revealed last week.

The company has also unveiled a new corporate identity: out goes PSA Peugeot Citroën, replaced with PSA Group. The move takes into account the presence of the DS brand alongside Peugeot and Citroën and is “aligned with the shift in its business model towards a broader portfolio of business activities”.

Announced today under its ‘Push to Pass’ plan, which addresses PSA’s intentions for the next five years, the company said it “aims to meet customers’ mobility needs by anticipating changes in car usage patterns”.

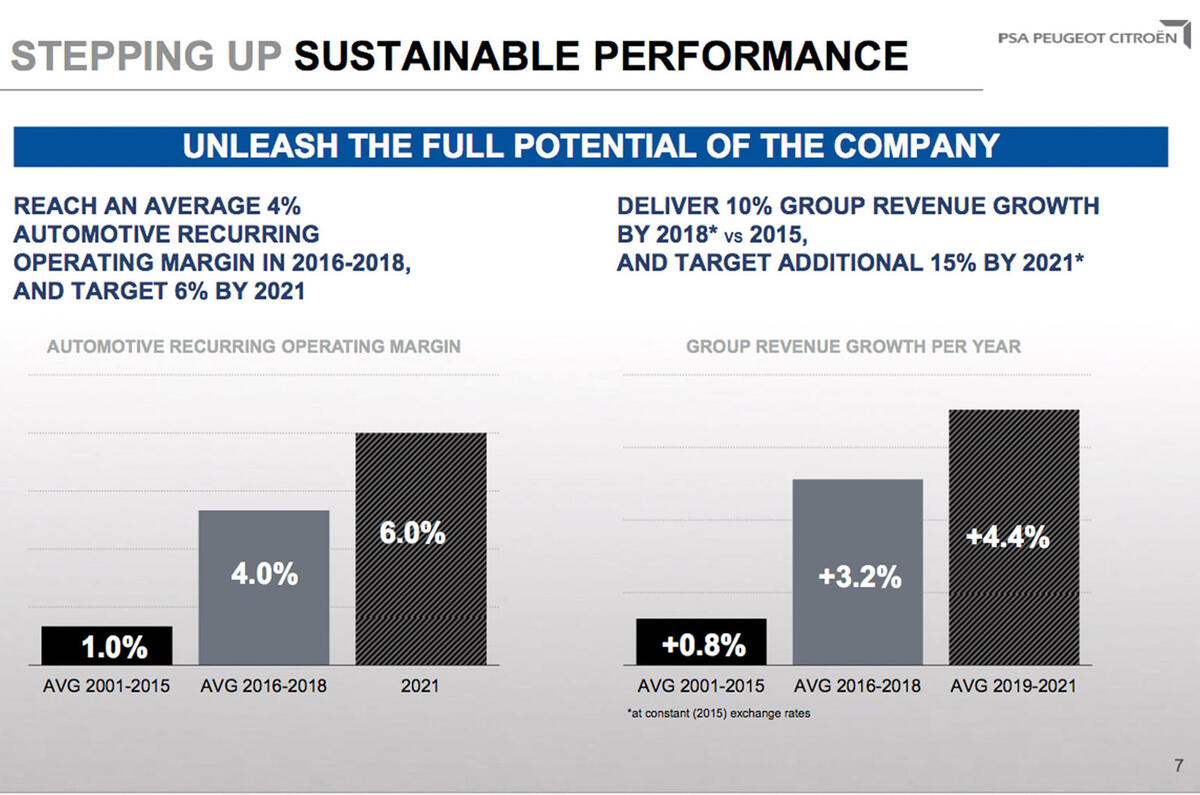

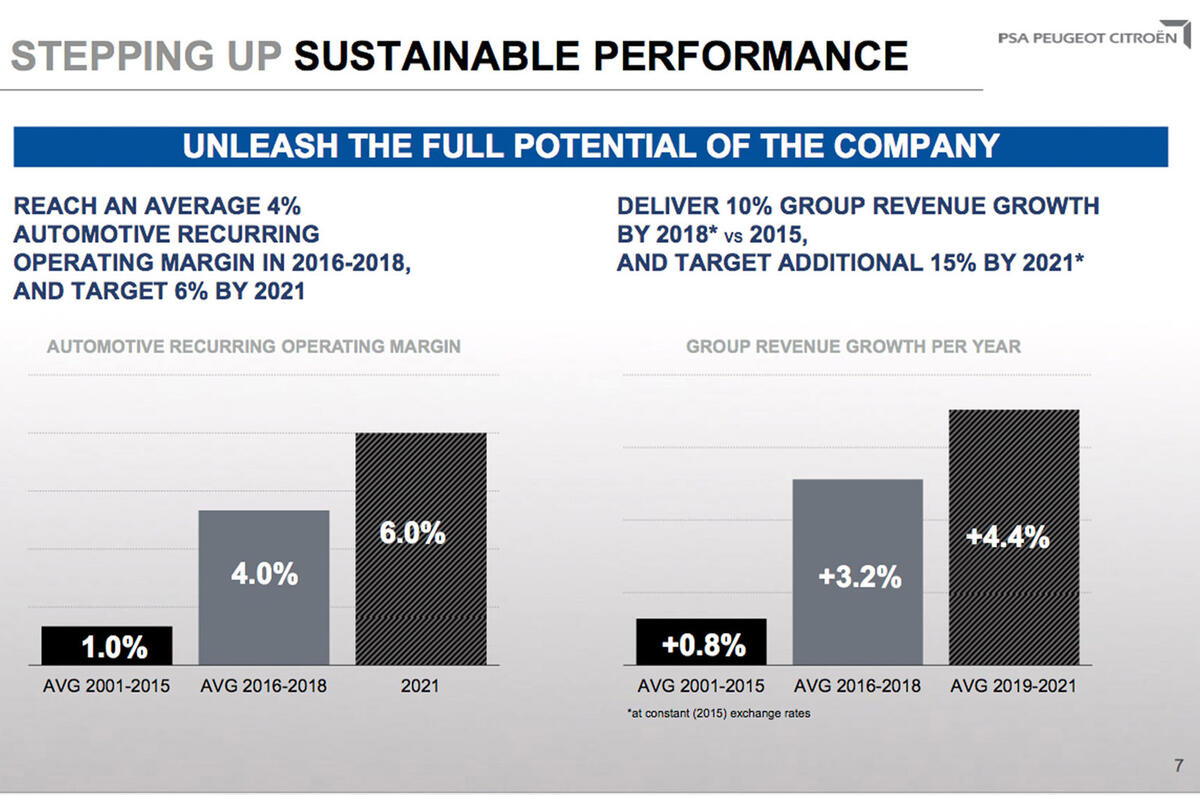

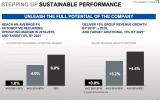

PSA boss Carlo Tavares, having already achieved all of the goals he set when he joined the firm in 2014, revealed the new objectives, including a 10% revenue growth in 2018 versus 2015 and target an additional 15% by 2021.

PSA seeking long-term prosperity

The group will spend the next five years expanding globally, targeting increased profit margins and overall revenue, getting involved in ‘mobility provision’ and expanding into more connected services.

Tavares said that after PSA’s dramatic financial turnaround over the last two years, the company was now “seeking long-term prosperity. Push to Pass is a bottom-up plan which will take us from a great car maker to becoming a great mobility provider.”

Tavares added that the philosophy of the company would change completely. “We will go from emphasis on the product to emphasis on the consumer, from the car to mobility, from having one business to having a portfolio and in going from being local to being global.

“Performance will matter more than the sheer size of the company,” he said, emphasising that PSA had to become significantly more “agile and rapid, bold and adventurous”.

Group to roll out 34 new vehicles

Over the next five years, there’ll be a brand new model every year for the Peugeot, Citroën and DS brands.

There’ll be a total of 34 new vehicles by 2021, including 8 LCVs and a ‘one-tonne’ pick-up, which is thought to be based on the Citroën 301 saloon and will be sold in developing markets.

The new vehicles will be based on one of two ‘multi-energy’ platforms and there will be seven plug-in hybrid models and four new battery-electric vehicles in the PSA line-up by 2021.

Tavares also briefly referred to the launch of a “electric four-wheel drive upper market vehicle” but gave no more details.

Increased profit margins targeted

Under the new financial targets, the company wants to see 4% profit margins for the next two years, before hitting 6% in 2021. In stark contrast, Tavares revealed that PSA’s profit margins between 2001 and 2015 had averaged just 1% per year.

Overall revenue for PSA also grew at snail’s pace, with an average of just 0.8% between 2001 and 2015. Tavares says the new target is growth of 3.2% between 2016 and 2018 and an average yearly revenue growth of 4.4% between 2019 and 2021.

New mission statements for brands

The groups three automotive brands have all been given targets and new mission statements. Peugeot is tasked with becoming the “best high end generalist brand” - or a direct VW rival. The company also wants to have 700,000 Peugeot customers connected to the brand via the web and to see further improvements in the brand’s pricing power.

Today, the average Peugeot is sold for around 2.4% less than an equivalent VW model. By 2018 that gap should drop to 1.3%, before overtaking VW by 0.5% by 2021. Tavares also revealed that “25% of profits” on the Peugeot 308 line come from sales of the upmarket GT and GTI models.

Citroën is aiming for sales growth of 30% by 2021, pushed by 12 new models rolled out globally, of which seven will arrive by 2018. It will become a “people-minded brand” under the heading “be different, feel good”. Citroën will offer a “fair pricing” and a “hassle-free relationship” with the brand.

Finally, the DS brand will offer “French avant garde luxury” and five new models will be rolled out globally as part of the “continued brand construction”. Like Peugeot, DS management is looking to reduce the pricing gap with established premium auto brands. Today, average selling prices are at nearly 8% lower and DS wants to reduce the gap to 3% lower than rivals by 2021.

PSA's global ambitions

The overall aim for PSA in Europe is to be the number one in non-premium brands for profitability and number two for market share, Tavares said.

In the wider world, PSA is looking to establish “new industrial footprints” in Iran, Algeria and Morocco and to hit 700,000 sales annual across the Middle East and Africa by 2021, with 70% of that output made locally.

In the India-Pacific region, Tavares said that PSA would enter a “partnership deal” to get into the Indian market, though there wouldn’t be any product launches until 2021. Although he gave no clues as to who PSA would tie up with, it has been rumoured that Tata, owner of Jaguar Land Rover, was a leading contender.

In Eurasia - the economically troubled area that includes Russia - the company wants to get back to break-even by “2017 at the latest”.

In China and South East Asia, PSA is aiming for a million sales by 2018, a 10% profit margin thanks to 20 product launches, which will include three plug-in hybrid models and two battery electric vehicles.

Manufacturing efficiency to improve

Improving the company’s overall manufacturing efficiency is also part of the ‘Push To Pass’ plan. PSA will slash 1.5bn euros from its research and development and capital expenditure costs between 2014 and 2018 and is aiming to improve its productivity by 5% per year between 2019 and 2021.

A significant 700 euros (perhaps more than 5%) will be cut from the average cost of manufacturing a vehicle in 2018 compared with the cost in 2015. PSA’s manufacturing efficiency should be also be boosted by 20% by 2018 compared with the 2015 benchmark.

PSA also wants to have a bigger share in aftermarket sales, using three different providers. As well as the dealer network, it wants to expand the more value oriented Euro Repair network and grow the revenue of the Mister Auto parts retailer by 500% by 2021.

In the word of connectivity, PSA is going to be involved in car sharing schemes (and has just taken a stake in the Koolicar enterprise), wants to use web connectivity for car sharing and fleet management and for more efficient aftersales service.

Maxime Picat, Peugeot brand boss, told Autocar that PSA was working with IBM on collecting live sensor information from the connected cars already on the roads and using it to create live traffic, accident, hazard and weather information for drivers.

Additional reporting by Hilton Holloway

Will PSA's 'Push to Pass' plan put it firmly 'Back in the Race'?

Join the debate

Add your comment

Still not convinced

I really hope they come out

Carlos Tavares has indeed

Personally I think he is going to struggle from here on in. As an outsider I see the whole PSA group as having a solid product base but not an outstanding one and this will only sustain sales for so long. The new model blitz will have to be exceptional to change that.

The "Push to Pass" plan also echo's what several other manufacturers have already laid out in their plans - cars are not the future (of profit), personal mobility in whatever form that takes, is.