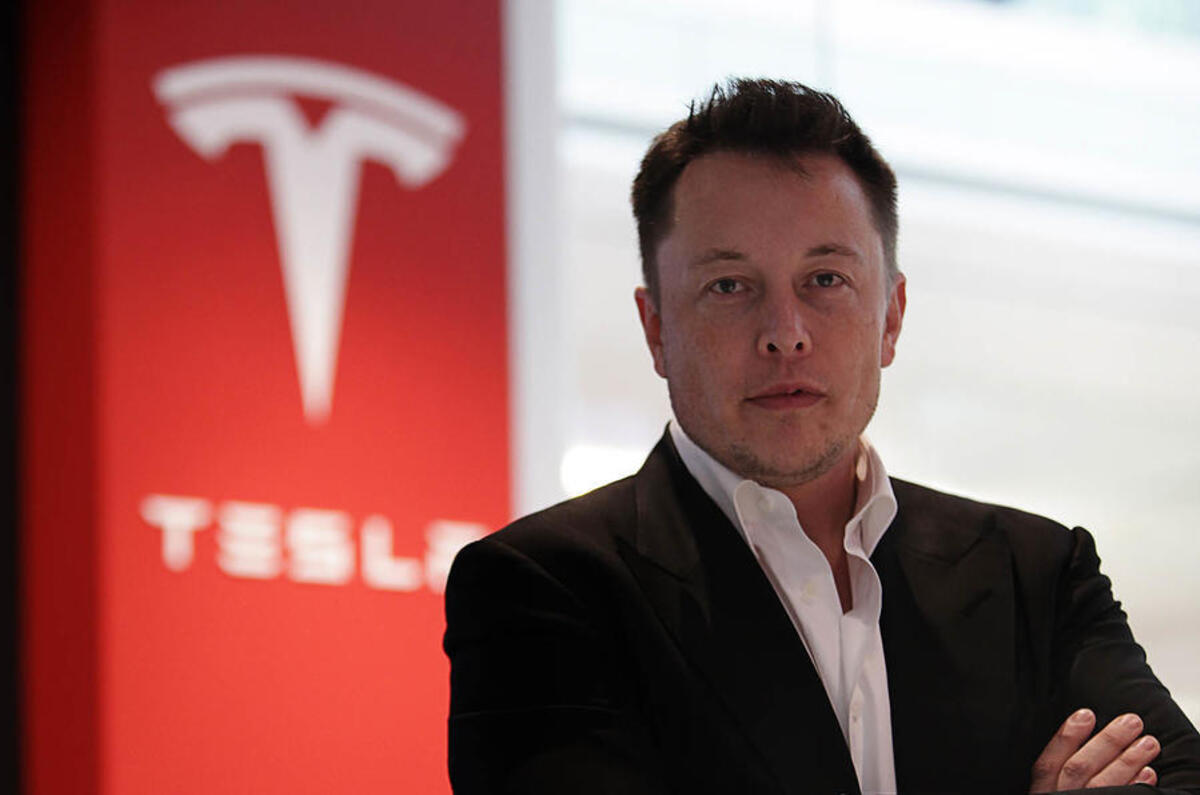

Tesla boss Elon Musk says he is considering taking the company private, a move he claims will allow the electric car firm to focus on its “long-term mission”.

Tesla Inc is currently listed on the American Nasdaq stock exchange, but its stock price has varied dramatically in recent months, with the firm under pressure to achieve production targets for the new Model 3.

Musk, who owns around 20% of the shares in Tesla, made the surprise announcement on Twitter. He said that he was considering taking the company private at $420 (£325) a share, roughly a fifth higher than the current market price.

Am considering taking Tesla private at $420. Funding secured.

— Elon Musk (@elonmusk) August 7, 2018

Musk followed his tweet by releasing an email he sent to Tesla employees, saying that while no decision has been made, the possible move was about “creating the environment for Tesla to operate best”.

He added: “As a public company, we are subject to wild swings in our stock price that can be a major distraction for everyone working at Tesla, all of whom are shareholders. Being public also subjects us to the quarterly earnings cycle that puts enormous pressure on Tesla to make decisions that may be right for a given quarter, but not necessarily right for the long-term.”

The 47-year-old added the move would protect Tesla from short sellers, who have effectively bet on the firm’s share price falling and, in Musk’s words, “have the incentive to attack the company”.

Musk's frustrations with analysts and short sellers have been evident in recent months, notably with a terse exchange on a conference call when he hit out at "boring, bonehead questions".

Musk said all current shareholders would have the choice to remain as investors in the private company, and that employees would remain shareholders. He added that in the future, when Tesla reached a “phase of slower, more predictable growth”, the firm could go public again.

Analysis: will the Model 3 make or break Tesla?

The proposal will have to be voted on by Tesla shareholders before it goes ahead. Following Musk’s initial tweet, trading in Tesla Inc was briefly suspended but ended at $380 (£296) a share, which was close to a record high.

Musk’s announcement came shortly the Financial Times reported that Saudi Arabia’s sovereign wealth fund had bought a $2 billion (£1.5 billion) stake in the firm.

Read more

Join the debate

Add your comment

I rememer that Bob Lutz (the

I rememer that Bob Lutz (the ex car executive) said last year that he did not expect Tesla to survive the rest of 2018 because of cash flow problems, and that Tesla would have to be bought by another company before the end of 2018. Other major car companies are on their way to surpass the technological edge that Tesla once had with battery cars.

I hate the short termism that

I hate the short termism that focussing on quarterly results produces, but analysts are not lovers/haters of the sort you find on Autocar threads, they are professionals desperate to get it right; Musk's view of them is Trumpian. I am not a pro or anti blowhard, but it is just possible that Musks worries that upcoming debt payments will generate even worse cash flow problems. So, rather than embarrass himself seeking protection from creditors under Chapter 11, he effectively wants to sell the company and its debts to an outfit with deep pockets. Outcome: he moves on after a brilliant creative phase, like PayPal, lets go of the drudgery of manufacturing, and moves on to the next great adventure, rescuing Martians trapped in caves or whatever.

SpaceX model is continously