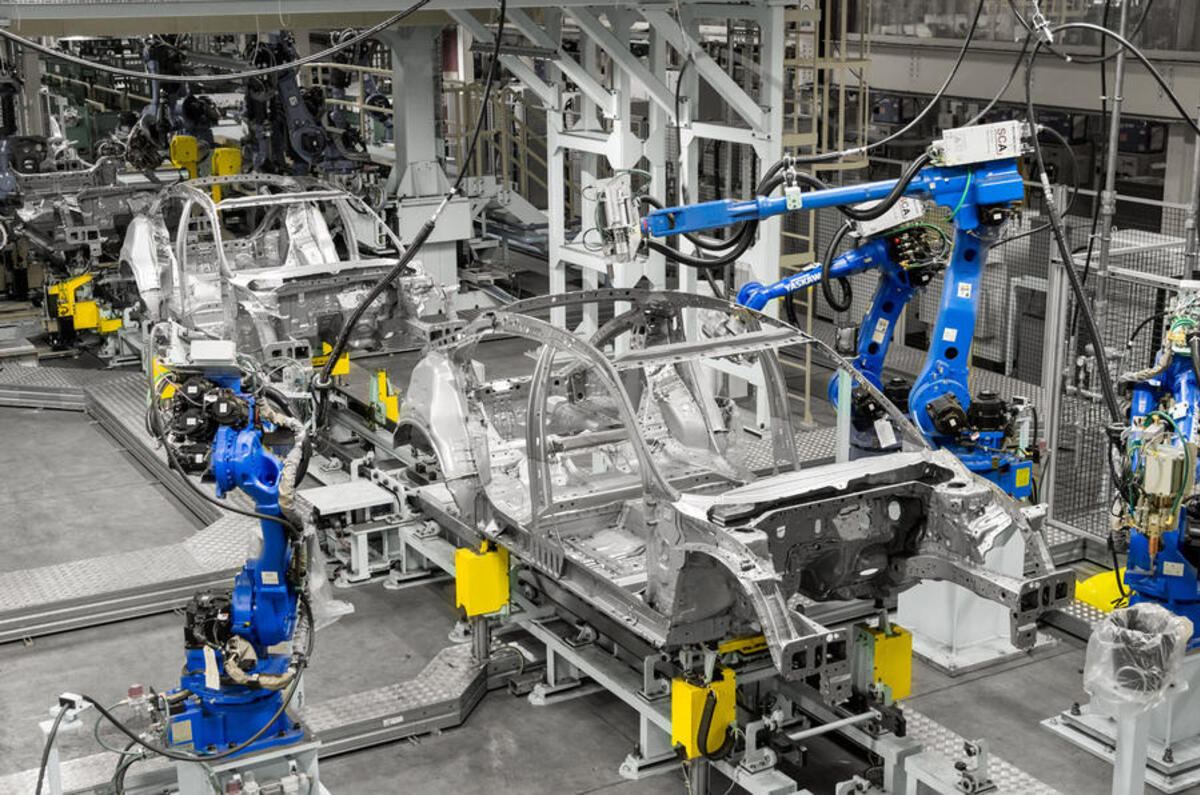

UK car production has fallen 42.8% in the first six months of this year, with just 56,594 units made - the lowest number since post-war materials rationing was lifted in 1954.

The dramatic, coronavirus-led drop-off has led to urgent warnings from the Society of Motor Manufacturers and Traders (SMMT) that there could be dire consequences for the automotive industry’s estimated 820,000 workers, around 168,000 of which are directly employed in manufacturing.

To date, the SMMT estimates that more than 11,000 jobs have been lost in the automotive sector, following cut-backs at manufacturers including Aston Martin, Bentley, McLaren and Nissan and retailers including Jardine Motors Group and Lookers.

However, SMMT chief executive Mike Hawes warned that the worst cuts were likely to come from October onwards, when the Government’s job retention furlough scheme is set to end.

“Nobody has a crystal ball, but it looks like we find out the true scale of the issues in the fourth quarter,” he said. “These figures are yet more grim reading for the industry and its workforce, and reveal the difficulties all automotive businesses face as they try to restart while tackling sectoral challenges like no other.

“Recovery is difficult for all companies, but automotive is unique in facing immense technological shifts, business uncertainty and a fundamental change to trading conditions while dealing with coronavirus.”

Why are fewer cars being manufactured?

Around 285,000 fewer cars have been made this year than last in the UK, with a combined estimated value of £7.8bn. Commercial vehicle production for the same period is down 24.8% and engine production down 38.8%.

Add your comment