British motorists contributed £46.6 billion in taxes to the Treasury in 2012, or nearly 8% of all the tax collected by the government that year.

These figures — the most up to date available — have been released by the European Automobile Manufacturers Association (ACEA).

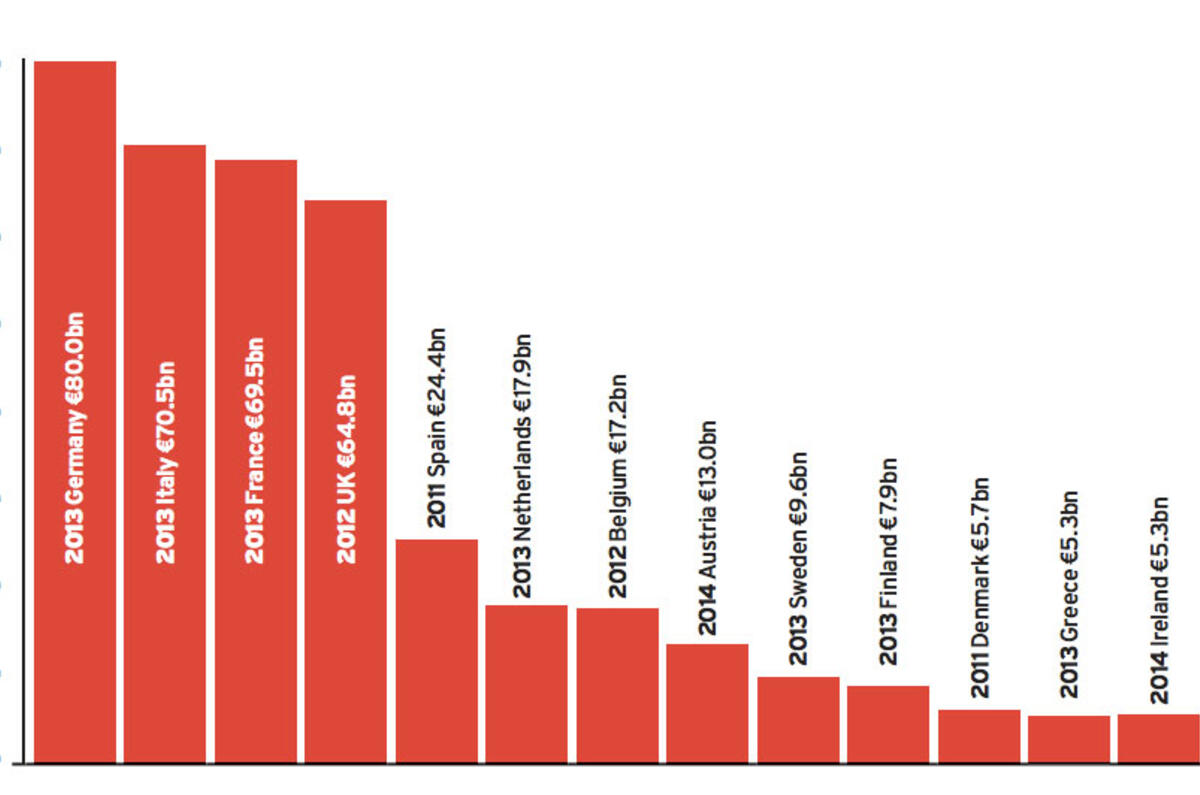

Using figures from the 14 EU countries that break out motoring taxes as separate statistics, including Germany, Denmark, Sweden, Italy, France and the UK, the total raised from motoring taxes was £284bn (€396bn).

The UK’s motoring-derived tax take was almost exactly the same as government defence spending, which came in at £46.4bn in 2012 and was just under half of what was spent on education.

According to the detailed breakdown, the largest amount of tax raised from UK motorists was from the sale of fuels and lubricants, adding up to £26bn. After that, it was VAT on vehicle sales, servicing, repair, parts and tyres, totalling £12.5bn. Annual ownership taxes came in at £5.8bn and “other taxes” at £1.5bn.

UK drivers were not the biggest contributors to their national government’s coffers. Germany’s drivers contributed some €80bn (£57bn) in 2012. This was followed by Italy’s drivers, who contributed €70.5bn (£50.6bn) in 2013 and the French, at €69.5bn (£54.3bn), also in 2013.

Dividing the UK’s £46.6bn motoring tax take by the UK’s 63.7 million population in 2012 shows a contribution of just £731 per head. Sweden’s drivers contributed €9.6bn in 2012 in motoring taxes, despite being a country of just 9.7 million people. But although the Scandinavian countries are noted for high taxes, that works out at just €989 (£710) per head.

Spanish drivers pay notably lower levels of motoring taxes per head of population than the European average. With a motoring taxes contribution of €24.4bn (£17.5bn) in 2011 and a population of 47.3 million, Spanish people paid motoring taxes of just £369 per head.

Join the debate

Add your comment

The real facts

A carefully constructured story?

As the UK is the third biggest country by population of those fourteen, the news that it takes the fourth largest amount of motoring tax hardly seems newsworthy.

You have broken it down into tax per head for one or two countries, but if you do the full table you get:

Belgium: €1,528

Austria: €1,510

Finland: €1,443

Italy: €1,156

Ireland: €1,145

France: €1,036

Netherlands: €1,057

Denmark: €1005

UK: €995

Germany: €984

Sweden: €978

Spain: €527

Greece: €492

Oh look, the UK is now in the bottom five! More informatively, the UK along with most countries charge/spend a thousand euros per head, with a few exceptions being 50% less or 50% more.