Slide of

Slide of

It’s the time of year when bean-counters of wealth are busy calculating who the wealthiest people in the world are.

This year Autocar has decided to get its calculator out too, but to produce a survey of all the wealthiest people and families who derived much or most of their wealth from the world of automotive and associated industries.

All the data is from Forbes, The Sunday Times, Bloomberg and other reputable sources with amounts in US dollars at current exchange rates. We start at US$1.6 billion, and work our way up to name the car world’s very wealthiest people:

Slide of

Slide of

Roger Penske - US$1.6 billion

Ohio-born Penske had a successful race car career before setting up his own IndyCar and Nascar teams in the late 1960s.

He later set up the Penske Automotive Group which operates a large chain of car dealerships across the world including the US, Germany, and Australia, as well as his famous yellow truck rental and leasing fleet, and other activities.

In the UK it owns, among other things, Sytner, the UK’s largest dealer group. Penske Automotive today employs over 26,000 people and had a turnover of US$22.8 billion in 2018.

Today aged 82, Roger Penske is still actively involved in the company as its chairman, and keeps tabs on its far-flung operations with the help of a Gulfstream G550 private jet.

Slide of

Slide of

Ford Family - $3bn

The Ford family today only owns around 2% of the car company’s shares, worth around US$740 million, but the family has benefited from dividends from the company for many generations.

That fact, plus the fact there are so many family members means an estimate on the total Ford family wealth is hard. Moreover, the Ford shares they do own have outsized voting rights, giving them 40% of the votes and effective control of the company.

Henry Ford’s great-grandson William Clay Ford Jr (pictured) is the current company chairman. His father William Clay Ford Sr was Henry Ford’s last surviving grandson, and died in 2014; it was believed that he was then the wealthiest single member of the family, with a net worth of around US$1.4 billion.

Forbes put the collective wealth of the Ford family at $2 billion in a 2015 survey; given stock market rises since then, we reckon it’s somewhat higher today.

Slide of

Slide of

Don Hankey - US$3.1 billion

Don Hankey was born in Los Angeles in 1943, and inherited his father’s Ford dealership in the city in 1972.

Running that business, he realised that a major barrier to car ownership was access to credit, and began a business in 1978 called Westlake Financial Services that focuses on ‘sub-prime’ car loans and now operates in every state of the US.

The company today claims to be the largest privately-owned finance company in the US, with $8.33 billion in assets under management in 2018. Business Journal put Hankey’s wealth at US$3.1 billion in 2018.

Slide of

Slide of

Bernie Ecclestone & family - US$3.25 billion

Bernie Ecclestone, the son of a trawlerman, left school at 16 and became a racing driver. He took over the Brabham Formula One racing team in 1972, which won two driver’s championships over the next 15 years.

More importantly, he realised the potential for motor sport’s most glamorous and prestigious form to become a professionalised marketing environment for sponsors and the road-car companies which operated the bulk of the teams racing, and drove this forward after he became chief executive of the Formula One Constructors Association in 1978, negotiating increasingly lucrative TV rights for the races.

Ecclestone also realised that although danger was an unavoidable part of car racing, much could be done to improve the safety of drivers and spectators, and worked closely with long-time associate and later International Automobile Federation (FIA) chief Max Mosley to this end.

Ecclestone finally left F1 management in 2017 when Formula One Group, which held the sport’s commercial rights, was bought by US giant Liberty Media, the operator of the Discovery Channel among much else.

The Sunday Times listed Ecclestone’s wealth at £2.5bn (US$3.25 billion) in 2019.

Slide of

Slide of

Pawan Munjal & family - US$3.5 billion

Pawan Munjal is the CEO of Hero Motocorp, both India and the world’s largest producer of two-wheeled vehicles.

The company was founded by his father Brijmohan Lall Munjal as a joint venture with Honda in 1984, and the company grew in tandem with India’s burgeoning demand for transport at a time when car-ownership was financially impossible for much of the population.

Honda brought engineering and manufacturing prowess, while Hero delivered local know-how, but tensions grew over royalty payments to Honda and technology sharing, and the fact that Hero Honda was banned from exporting into many markets.

The parties divorced in 2011, but Hero has prospered since with a wide-range of two-wheelers targeting every income segment; it sold 7.2 million examples of them in 2017, delivering revenues of US$4.4 billion.

Slide of

Slide of

Wei Jianjun & family - US$3.8 billion

Great Wall Motors was established in 1984 as a pick-up and truckmaker, and Mr Wei took over the company in 1990.

Seeking to capitalise on fast-growing demand for passenger cars in China the company began producing SUVs and sedans after 2010. It launched a new electric car called the C30EV in 2017, while a new premium SUV brand WEY, named after Mr Wei, also arrived that year.

In 2018 it announced that it and BMW will produce the electric Mini in China, targeting an annual output of 160,000 cars. Great Wall had annual sales of US$14.4 billion in 2018, with total unit sales of 1.05 million vehicles.

There are knock-down kit workshops of Great Wall vehicles in various locations, but formal overseas factories have opened in Bulgaria and Russia. Mr Wei owns 85% of the company. The wealth estimate is from Forbes.

Slide of

Slide of

Liang Wengen - US$3.9 billion

Mr Liang chairs Sany Heavy Industry, the world’s eighth-largest construction equipment maker with sales totalling US$5.9 billion in 2017, ahead of somewhat better-known companies like John Deere.

Its primary product lines are mobile concrete mixers, cranes, and excavators. Sany started as a welding materials firm in 1989. Mr Liang and his family own 20% of the company.

Slide of

Slide of

Dan Friedkin & family - US$4.1 billion

Houston-based Gulf States Toyota (GST) was established in 1969 by Tom Friedkin, a friend of racing legend Carroll Shelby.

Shelby turned down an opportunity to become a dealer for Toyota’s then-nascent US operations, and suggested Friedkin instead. Friedkin died in 2017 and GST is now run by his son Dan. Today GST is America’s second-largest Toyota franchise, operating 154 dealerships in Arkansas, Louisiana, Mississippi, Oklahoma and Texas.

It sells approximately 1-in-8 of every Toyota the Japanese company sells in the US, and in recent years has been a major indirect beneficiary of America’s shale-oil boom, an industry that generates huge demand for pick-up trucks such as those sold by GST.

With revenues of US$9 billion in 2018, the company is wholly owned by the Friedkin family. The family also has interests in holiday resorts and entertainment.

Slide of

Slide of

Vikram & Siddhartha Lal - US$4.53 billion

You may not have heard of Mr Lal’s Eicher Motors, but you may know of its most famous brand, Royal Enfield.

It was formed as a motorcycle maker in the UK in 1901, but was battered by Japanese competition and was out of business by 1971. But not before the brand and its machines had made their marks in India, and production had started in Madras (now Chennai).

In 1994 the Indian Royal Enfield merged with Eicher. The company underwent a renaissance after Mr Lal’s son Siddhartha (pictured) began running it in 1995. Just 22 years of age at the time, he was in touch with the company’s youthful market, and spearheaded successful new bikes including a new Bullet, an upgraded version of a bike first built in 1949.

Royal Enfield prospered, and today exports its sturdy and affordable machines to over 50 countries, selling 615,901 two-wheelers in its last financial year.

Mr Lal handed over the reins of Eicher to his son in 2006. Eicher also makes trucks and buses, and is 47% owned by Mr Lal and family. This wealth estimate is from Bloomberg.

Slide of

Slide of

Peugeot Family - US$4.8 billion

Originally founded in 1810 as a maker of coffee mills, the Peugeot family turned to cars in 1889. Peugeot itself is now part of the wider PSA Group, and although no longer part of the group’s management, family interests still own around 9% of the company.

It has a wide variety of other interests including multiple stakeholdings in private equity, property, auto and aerospace component companies, among others.

Slide of

Slide of

Wang Chuanfu - US$4.8 billion

Mr Wang may reasonably lay claim to be the Elon Musk of China. Why? Well, he founded BYD in 1995, initially focused on making batteries for the booming mobile phone market. Mr Wang realised that booming demand for cars in China represented an opportunity, and opened a car-making arm in 2003.

Capitalising on its battery know-how, BYD trumped the world by producing the first ever mass-produced plug-in hybrid car, the F3DM, in 2008.

That same year the sharp-eyed famed American investor Warren Buffett thought the company might be onto something, and bought a 10% stake. Prodded by the Chinese government concerned at urban pollution levels, BYD Auto has since launched a range of pure electric cars, and sold a total of 520,687 vehicles in 2018, with revenues of US$16.35 billion.

This wealth estimate is from Bloomberg.

Slide of

Slide of

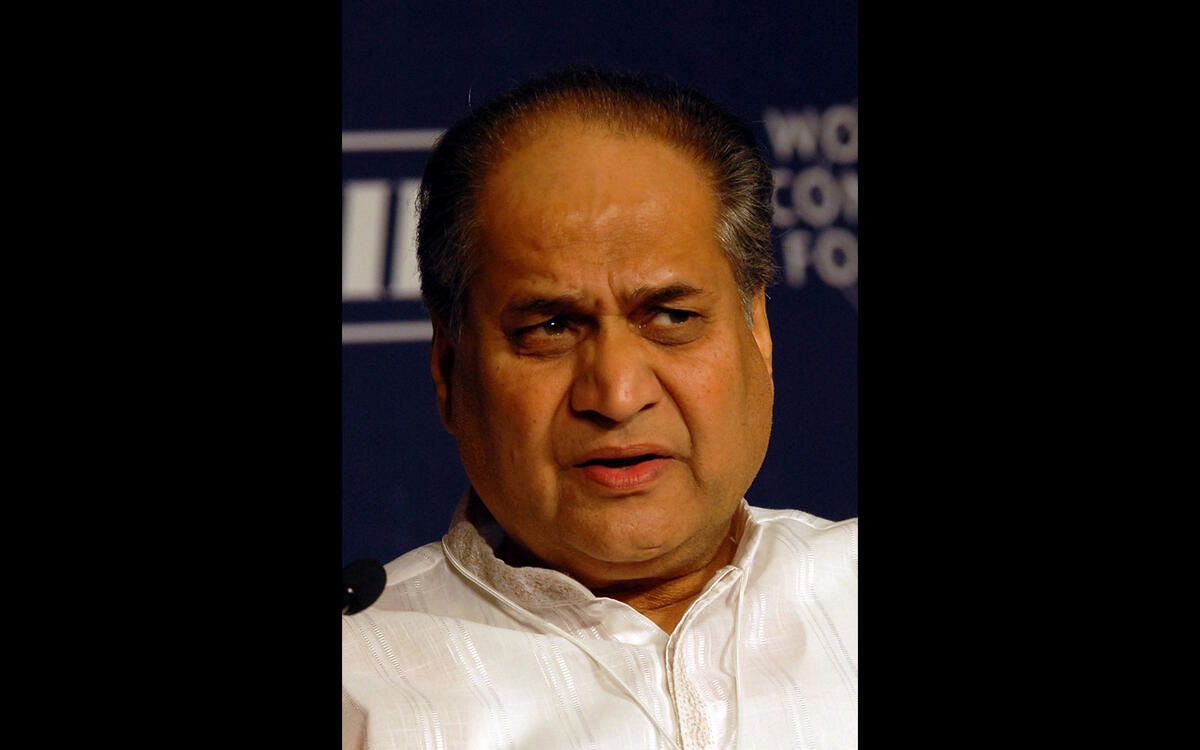

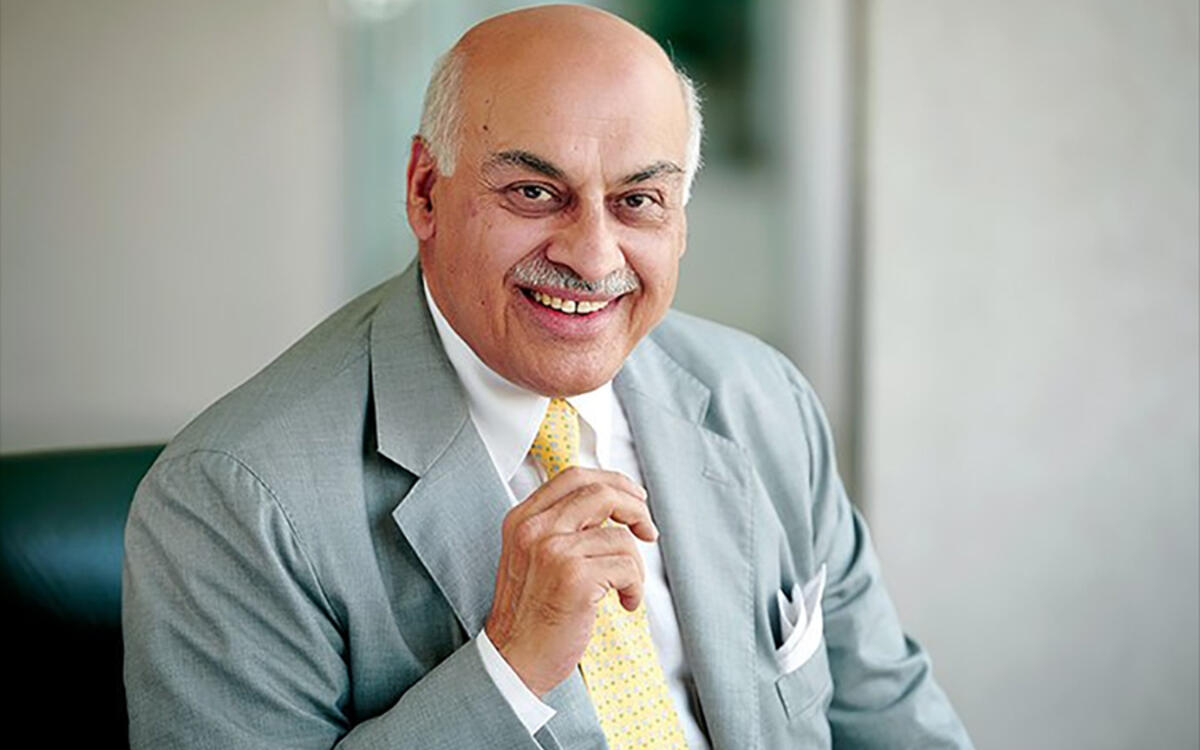

Rahul Bajaj - US$5.36 billion

As you may have already gathered, bikes are big in India, and the foundation of many an Indian fortune.

The Bajaj Group was founded in 1926 by Rahul’s grandfather Jamnalal, and began making motorcycles and rickshaws in the 1940s. It pioneered the use of more refined four-stroke motorcycle engines in the Indian market, later with the help of partner Kawasaki.

As well as two-wheelers, Bajaj Auto also makes Qute, a 4-wheel rear-engined, rear-wheel drive quadricycle.

The group also operates in financial services, travel and lighting. Family interests own around 42% of Bajaj Auto. This wealth estimate is from Bloomberg.

Slide of

Slide of

Anthony Bamford & family - US$5.4 billion

The Briton Joseph Cyril Bamford started JCB in 1945 with a farm trailer made from surplus war materials, and in the 1950s introduced its backhoe loader, a four-wheel drive tractor unit with a shovel at the front and a digging bucket on the end of a two-part articulated arm at the rear.

This item of machinery is present on virtually every construction site in the world, and remains the company’s signature product (pictured).

Bamford retired in 1975 and handed the business over to his sons, and son Anthony (now Lord Bamford, pictured) is now company chairman. Anthony expanded the company outside the UK to become a multinational, with factories in 18 countries including Germany, USA, and India, and it employs over 12,000 people.

Sales revenue in 2017 was US$4.3 billion, and the private company is entirely owned by the Bamford family. The Sunday Times estimated the family’s wealth in 2019 at £4.15 billion (US$5.4 billion).

Slide of

Slide of

Vivek Chaand Sehgal & family - US$6.2 billion

Neither Vivek Chaand Sehgal nor the Samavardhan Motherson Group he chairs are familiar names in the west, but the company turned over US$10.5 billion in 2017-18 and is India’s largest car parts maker.

He founded the company in 1975 with his mother, and grew it from small beginnings as a cablemaker to a global leader in wiring harness production with 135,000 employees.

Its most important unit is Motherson Sumi Systems, a joint venture with Japan’s Sumitomo. Its clients include Maruti Suzuki, Volkswagen, BMW, Mercedes, Ford and Toyota.

Mr Sehgal and his wider family has a 90% stake in the business, and in 2017 he became an Australian citizen.

This wealth estimate is from Bloomberg.

Slide of

Slide of

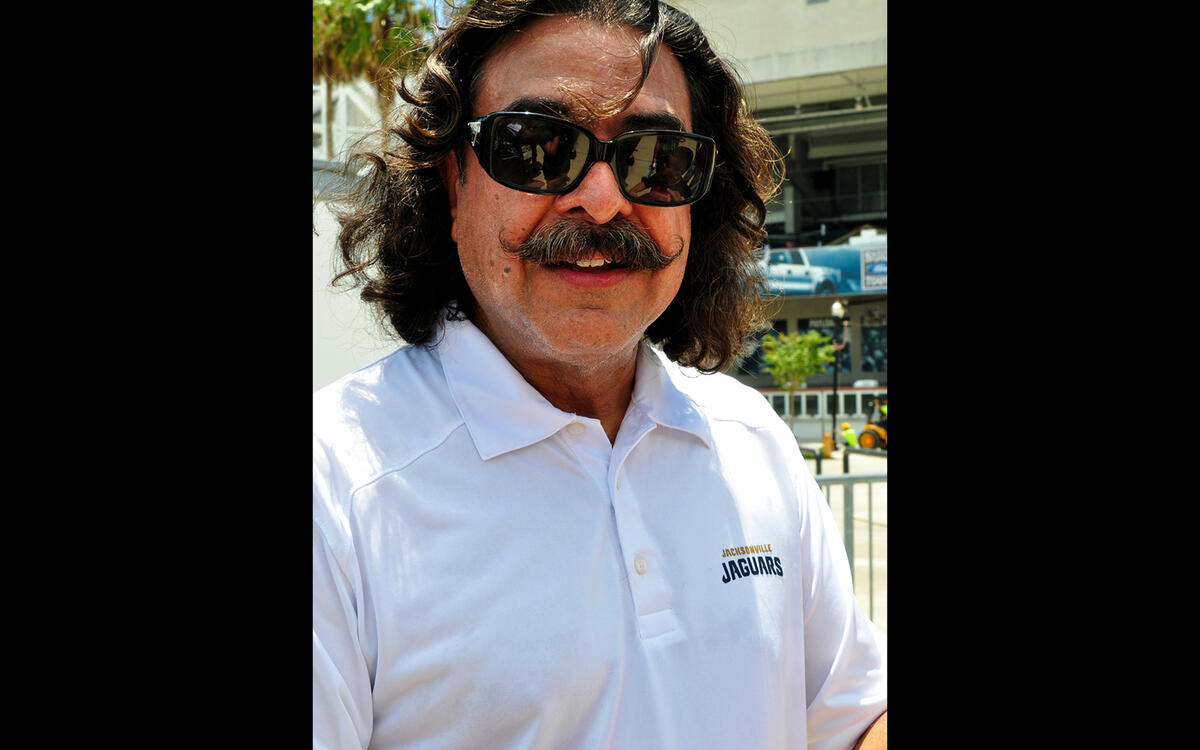

Shahid Khan - US$6.8 billion

Shahid Khan was born in Pakistan in 1950, and moved to the US in 1967. After college he rose rapidly at US parts firm Flex-N-Gate, and eventually purchased the company in 1980.

The company quickly became a primary supplier of bumpers to Detroit’s Big Three, and then later Toyota, BMW and Nissan.

It now also produces pedal systems and instrument panels. A private company majority owned by Khan and his family, it had annual sales of US$7.5 billion in 2017.

In 2012 Khan bought the NFL team Jacksonville Jaguars, and in 2013 the English Premier League soccer team Fulham Football Club. He made a bid to buy London’s Wembley Stadium in 2018, but later dropped the offer. This wealth estimate is from Forbes.

Slide of

Slide of

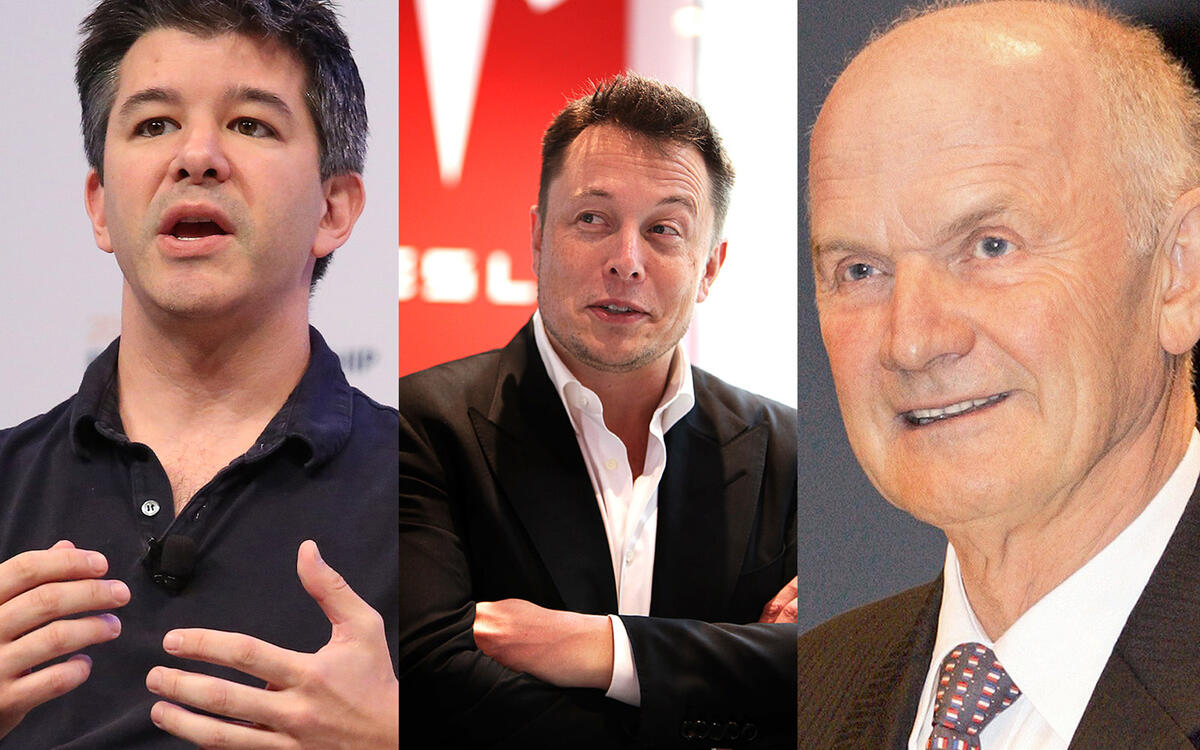

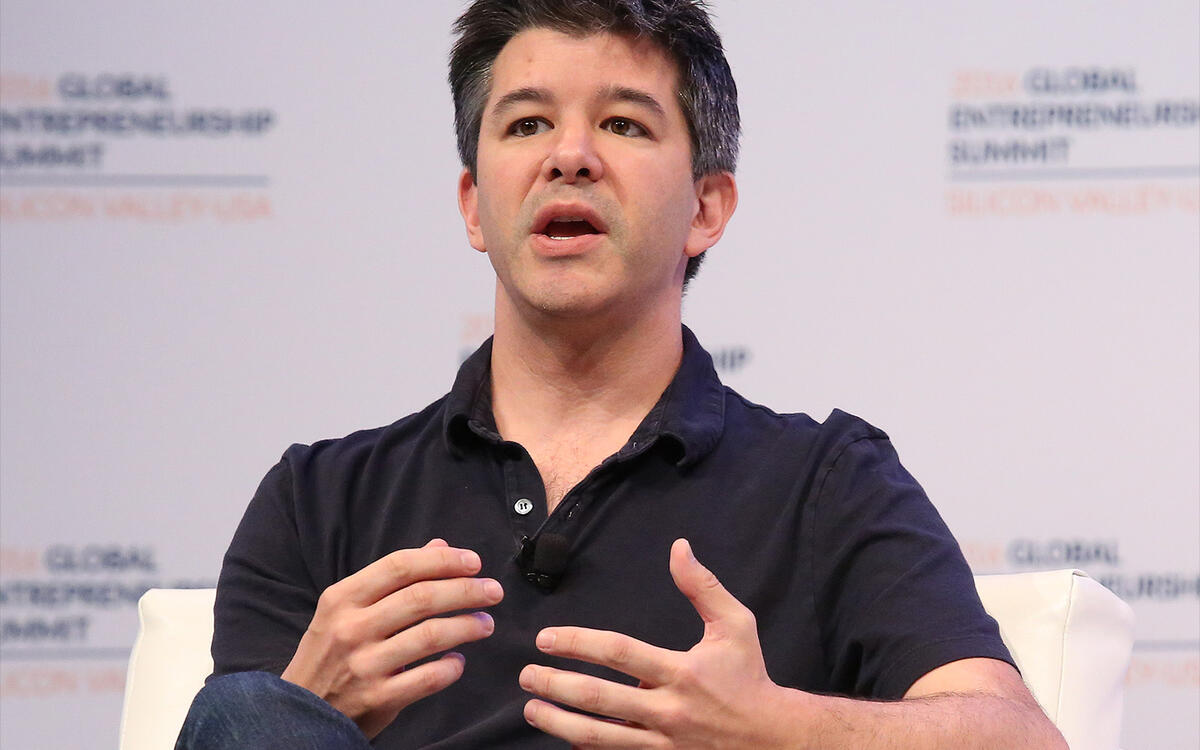

Garrett Camp & Travis Kalanick - US$9 billion

Whether Uber can be strictly speaking classed an automotive company is open to question. After all, it neither makes nor owns any of the taxis that operate under its name. What is not in doubt is the impact it’s had on how people move around the world, with the ride-hailing app installed on the mobile phones of the majority of readers of this story.

Garrett Camp cofounded the ride-hailing giant with Travis Kalanick (pictured) in 2009. Both were frustrated with local taxi services in San Francisco and concluded that the advent of the modern location-aware smartphone – as heralded by Apple's first iPhone in 2008 – might just offer a better way.

The rest as they say is history. It now operates in 785 major cities in 60 countries across the world, has 91 million monthly users, and had US$11.3 billion in revenue in 2018. It has just gone public, with a total market value of around US$75 billion; Camp, who earlier founded StumbleUpon, currently owns 5% of the company, while its former CEO Kalanick owns 7%. Uber’s next trick? How to crack autonomous driving.

Slide of

Slide of

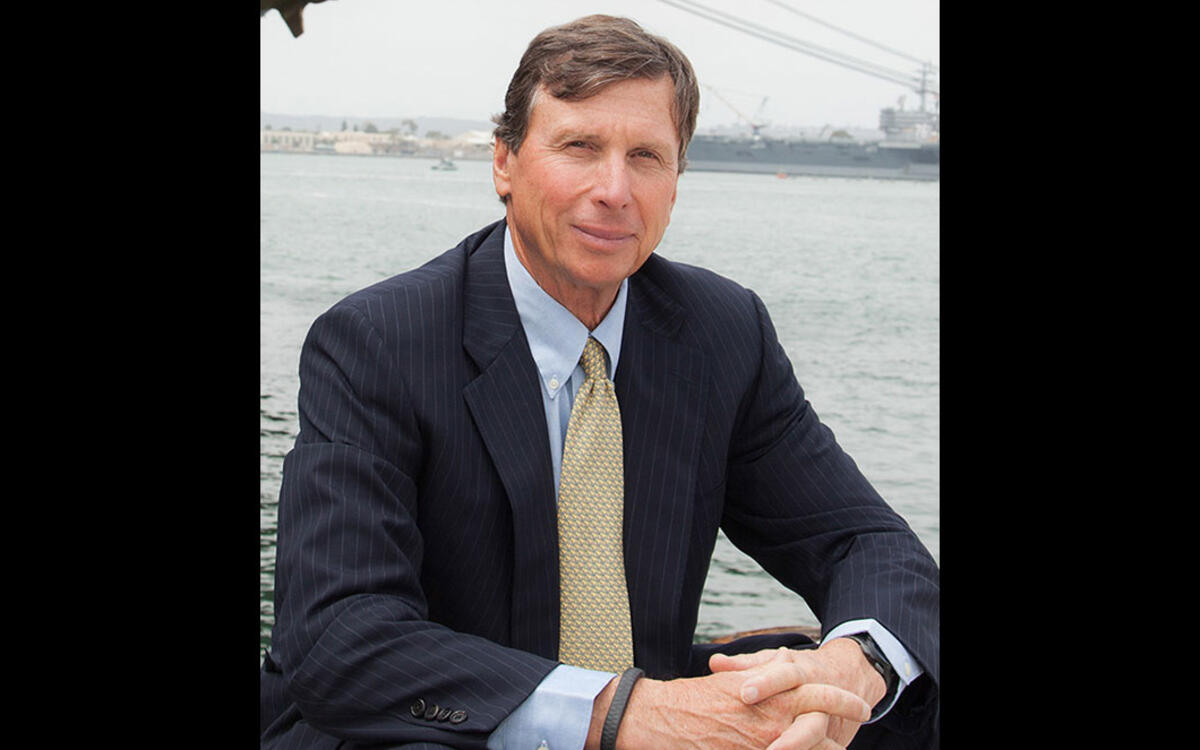

James C. Kennedy - US$9.3 billion

Jim Kennedy is chairman of the private Atlanta firm Cox Communications. Originally founded in 1898 by Kennedy’s grandfather, it was originally a newspaper company. It later developed various cable TV and television production interests.

In recent decades it made a major expansion into automotive, with dealer-facing technology operations like dealer.com, auction operations such as Manheim, and consumer-trade websites and services AutoTrader.com and Kelley Blue Book.

The group as a whole had annual revenues of US$21 billion in 2018, and is majority owned by the wider founding family. The wealth estimate is from Bloomberg.

Slide of

Slide of

Zeng Yuqun & Huang Shilin - US$10.2 billion

You may not have heard of Zeng Yuqun nor Huang Shilin nor the Contemporary Amperex Technology (CATL) company that has made their fortune, but you may already have used their products, and certainly have a good chance of doing so in the future.

That’s because CATL is the world’s largest producer of lithium-ion batteries for electric vehicles.

Founded only in 2011, CATL now has 10,000 employees in two research centres in China and another in Berlin, CATL supplies Hyundai, Volkswagen and Geely among others, and will supply BMW with batteries for the forthcoming electric Mini (pictured) and i5 cars.

It is also building a new battery factory in Germany to service BMW and VW contracts. CATL floated in 2018, and the share price has grown sharply. At current values, Mr Zeng’s 26% stake is worth US$7 billion and Mr Huang’s 12% US$3.2 billion.

Slide of

Slide of

Chung Mong-koo & family - US$14.8 billion

Hyundai was founded by Chung Ju-yung in 1947 as a construction company. Its automotive arm began in 1967, while the group began ship-building in 1973.

Mr Chung died in 2001, and his son Chung Mong-koo is now chairman of Hyundai Motor, South Korea’s largest car firm. It also has a large stake in Kia Motors, and the two companies work closely together on product development.

Hyundai Motor had total sales of $87bn in 2018. Chung Mong-koo and other family members have controlling interests in all the various complex entities that make up the wider group, including in Hyundai Mobis, an autoparts giant.

Slide of

Slide of

Georg Schaeffler - US$15.2 billion

German-born Schaeffler owns the Schaeffler Group with his mother, Maria-Elisabeth. The industrial firm was originally started in 1946, and acquired ball-bearings giant Fischer's Automatische Gussstahlkugelfabrik in 2002.

Then in 2008 it acquired parts and tyres giant Continental AG, though it now only owns 46% of that company.

The prospect of harder times for Germany’s car industry has hit the Continental share price in the past year, and thus the family’s wealth has fallen. The group had US$16 billion in sales in 2017. The wealth estimate is from Forbes.

Slide of

Slide of

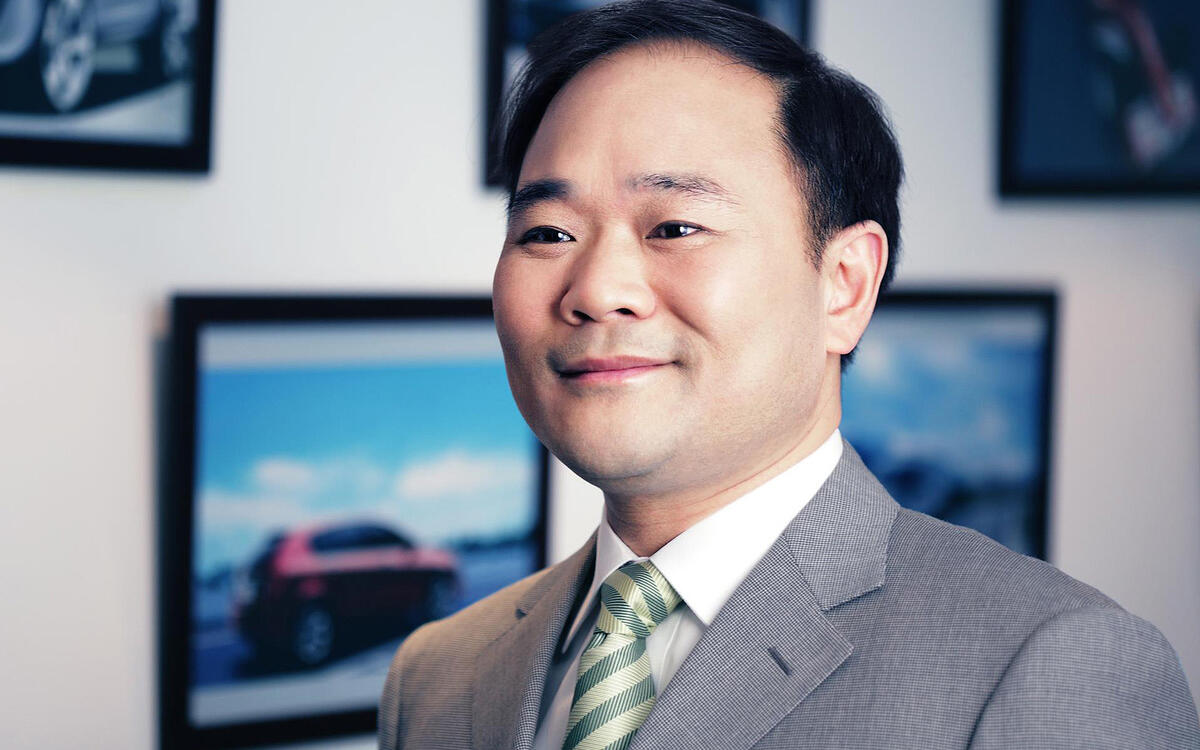

Li Shufu - US$15.6 billion

Mr Li founded Geely in 1986, at the age of 23, and it originally made refrigerators for the Chinese domestic market.

It expanded into motorcycle production in the 1990s, and built its first car in 1998, a small wagon called the Geely HQ.

Geely then grew rapidly off the back of surging demand for cars in China’s fast-growing economy. This gave it the financial firepower to acquire Volvo Cars from Ford in 2010, for US$1.8 billion.

Geely has proved a good parent for Volvo, investing enough for the Swedish firm to re-engineer a whole new platform from which it’s launched a range of attractive and strong-selling new cars like the XC40 compact SUV, and making Volvo a true member of the premium car class for arguably the first time.

Geely has since acquired Lotus Cars and Proton, major stakes in trucks giant Volvo Group and Mercedes owner Daimler, and is now launching electric SUV specialist Lynk & Co. Mr Li is Geely’s largest shareholder.

Slide of

Slide of

Agnelli family - US$19 billion

The Agnelli dynasty and fortune began when Giovanni Agnelli founded Fiat in Turin in 1899. He died in 1945, and under non-family management the company grew after World War Two with Italy’s thirst for mobility. Giovanni’s grandson Gianni became head of Fiat in 1966 and - despite an often difficult political situation in Italy - Fiat prospered, and Agnelli diversified the family’s wealth into related industries like farm machinery, later known as CNH Global.

Of great long-term consequence for the Agnelli’s wealth, Fiat also fully acquired Ferrari in 1988. Fiat had major problems in the early 21st century and entered a brief ill-fated alliance with General Motors. GM paid Fiat $2 billion to exit this, and Fiat began a renaissance under new CEO Sergio Marchionne (pictured right) with popular new cars like the reborn Fiat 500.

It acquired Chrysler for nothing in the wake of the 2008 global financial crisis, though all its liabilities as well, creating Fiat Chrysler Automobiles (FCA).

Today the Agnelli clan is led by John Elkann (pictured left), grandson of Gianni Agnelli, who is chairman of Exor, in which family interests hold a majority stake. It in turn owns large stake in FCA, CNH Global, Ferrari, and the Juventus soccer club, among other companies. In 2018 Reuters valued the family’s automotive interests at €17 billion (US$19 billion).

Slide of

Slide of

Elon Musk - $21bn

The serial entrepreneur Elon Musk was born in Pretoria, South Africa in 1971. In 1999 he co-founded a company called X.com which would ultimately become online payments giant PayPal.

Envisioning an electrified future for the car world, he co-founded Tesla Motors in 2003. The company launched its first electric car, the Lotus Elise-derived Tesla Roadster in 2008. Apart from its excellent performance, the car impressed as the first electric car with a useful single-charge range, of around 200 miles.

The Model S executive car of 2012 was the real game-changer for the company, offering comfort, refinement and a range of up to 300 miles, as well as offering owners free use of high-speed charging points.

The rest of the car industry has been in catch-up mode since. However, Musk’s interest in electric cars pales in comparison to his obsession with space, and his aim to get to Mars via his SpaceX company, incidentally formed even before Tesla, in 2002. Musk owns around 19% of Tesla, a stake worth around $9 billion, but he has other wealth. The wealth estimate is from Forbes.

Slide of

Slide of

Stefan Quandt and Susanne Klatten - $38 billion

The Quandt family emerged from the ashes of World War Two with large holdings in both BMW and Daimler-Benz, as well as the Varta chemicals company.

Herbert Quandt (1910-82) nearly merged the two car giants together in the 1950s but was dissuaded by trade union opposition. The Daimler stake was sold in the 1970s, while the family took full effective control of BMW and provided the investment in new models that proved key to the company’s later success.

After Herbert’s death, his widow Johanna was one of Europe’s wealthiest women, with a net worth of around US$14 billion. When she died in 2015, her two children Stefan Quandt and Susanne Klatten inherited much of that together with their existing investments. The pair together own around 43% of BMW, where Quandt is deputy chairman.

He also has interests in digital security, logistics and renewable energy, while Klatten owns a controlling stake in Altana, a successor to Varta. The wealth estimate is from Bloomberg.

Slide of

Slide of

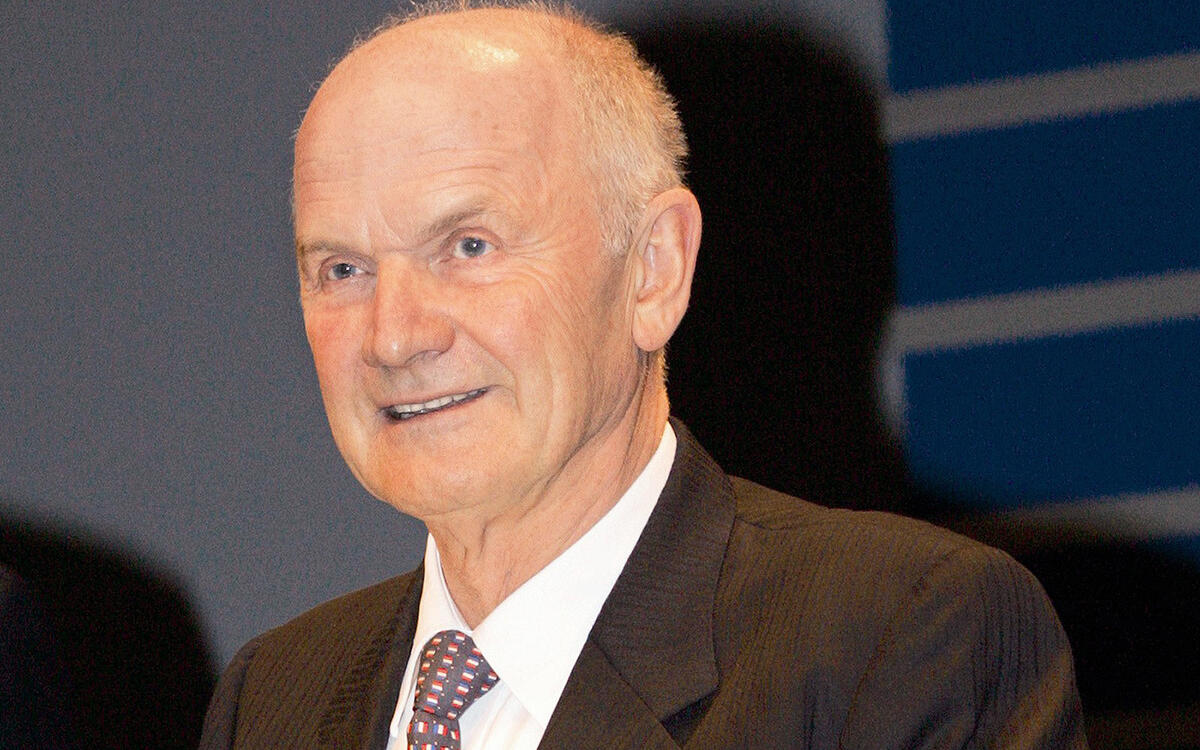

Porsche & Piëch families - US$52.8 billion

Ferdinand Porsche famously designed the Volkswagen Beetle when his own company was merely a development consultancy in the 1930s.

His son Ferry instigated setting up a stand-alone company after World War Two, and produced its first Porsche-branded car, the 356. Meanwhile, his daughter Louise married Anton Piëch, a lawyer who went onto manage the vast car factory – later named Wolfsburg - where Volkswagens are built to this day.

The family connection meant that Porsche and Volkswagen were forever closely connected, with many shared projects, engines, and components. This culminated in the two companies merging in controversial and complex circumstances in the wake of the 2008 global financial crisis.

Louise and Anton’s son Ferdinand Piëch (pictured) created the Quattro family for Audi before, many say, going onto save Volkswagen itself as its CEO when it hit major problems in the early 1990s.

Today, the collective families of Piëch and Porsche own 30.8% of Volkswagen, a stake worth around US$28 billion today, but the family has other investments according to multiple sources.

Despite headwinds from the company’s dieselgate scandal that broke in 2015, Volkswagen was the world’s largest automotive producer in 2018, with sales of 10.8 million vehicles, and revenue of US$268 billion.

Slide of

Slide of

Honourable mentions

British vacuum cleaner mogul James Dyson (pictured left - net worth: US$16.4 billion) can’t sell you a car – yet. But his company is working on a new electric car, which will cost $2.7 billion to develop and will launch in 2021, to be built in Singapore.

British chemicals king Jim Ratcliffe (pictured centre - US$23.6 billion) is planning a tough off-road SUV dubbed ‘Projekt Grenadier’ in the mould of the Land Rover Defender, which left production in 2016 and hasn’t yet been replaced.

Sergey Brin and Larry Page - (collective net worth of around US$103 billion) - are the founders of Google, and it’s been working on autonomous cars (now in a division called Waymo) for a decade now (pictured), but they also can’t sell you a car - yet. Wealth estimates from Sunday Times Rich List 2019.

Join us as we count through the richest of the rich in the automotive world

Advertisement