Covid-19 dominated the headlines last year and, unsurprisingly, wreaked havoc with global new car markets in 2020, preliminary figures from analysis firm Jato Dynamics reveal. The top 11 global markets sold 7.71 million fewer cars in 2020 (taking into account the output of 30 factories of typical 250,000 units-per-year size) than in 2019 for an unprecedented 12.6% year-on-year drop. Just one of those countries – South Korea – recorded an increase, while the UK’s 28% decline positioned it as the worst performer globally.

Of course, there were bright spots for some amid the carnage: Toyota regained its crown as the biggest global car maker, electric cars continued to sell in ever-bigger numbers and premium cars remained in significant demand in China – a hugely important metric for Europe’s car industry.

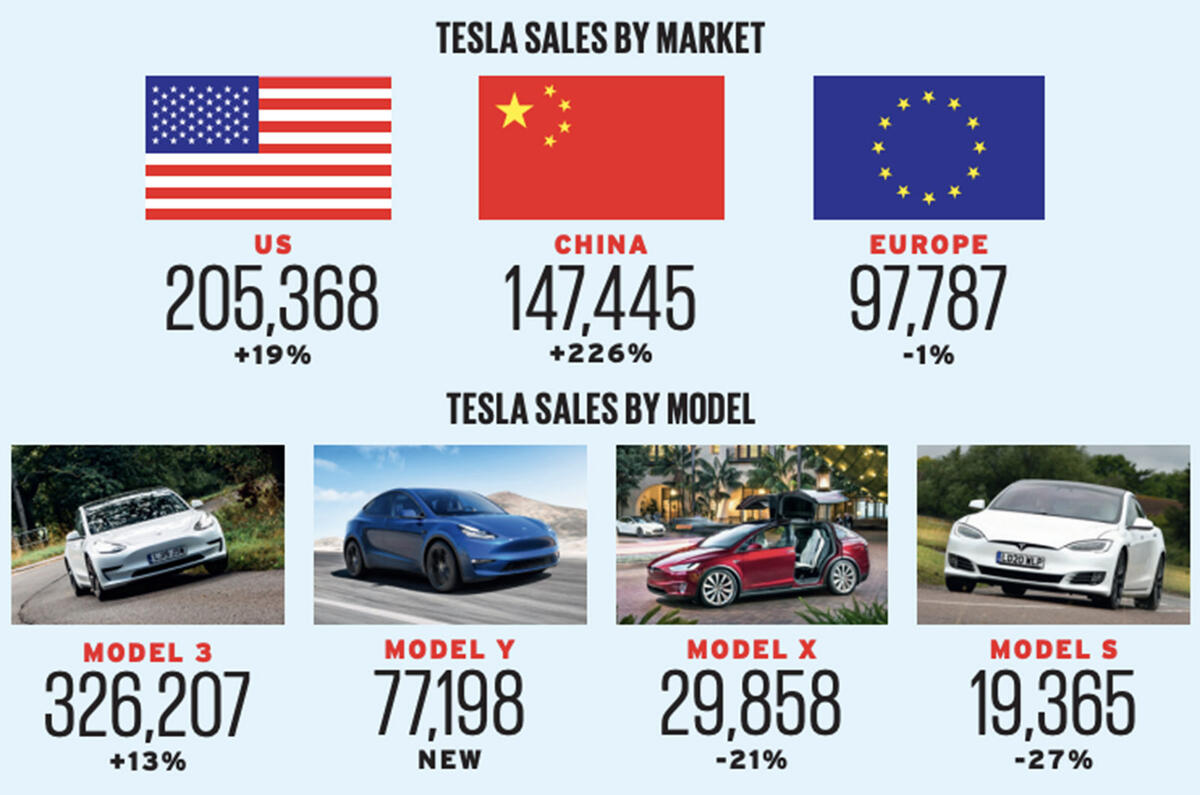

In fact, the 28% increase in global battery-electric car sales highlights the investment, technology and political push behind them.

Another significant trend is the continuing slide in luxury saloon demand, as buyers move to SUVs. Cadillac and Lincoln, for example, pulled three saloons from the market, while the big BMW X7 made an instant impact in its first full year on sale.

Elsewhere, Mercedes-Benz sold more cars than BMW, as in 2019, but when all brands are included, the BMW Group was again bigger than Daimler.

Meanwhile, Porsche’s evergreen 911 is showing no sign of losing its global crown, while the new mid-engined Chevrolet Corvette was also a rip-roaring success in a buoyant supercar market.

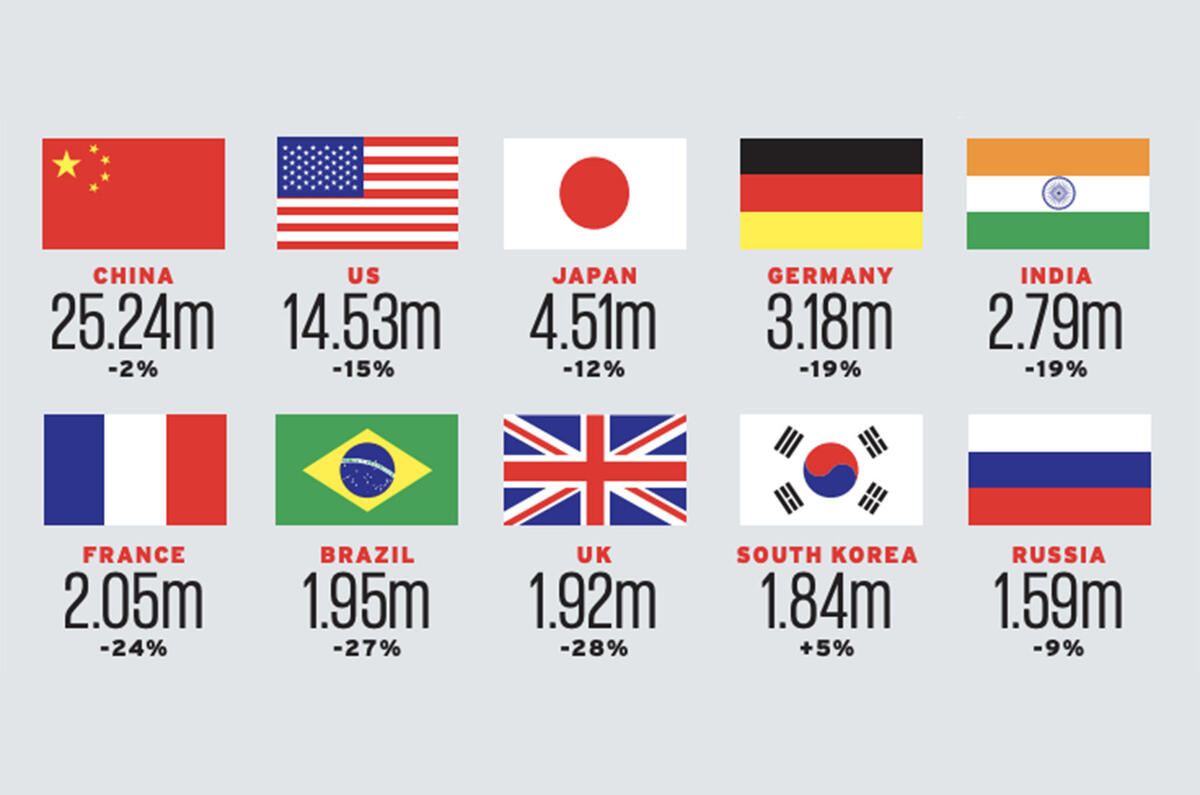

Significant sales declines across top 10 markets

China was the first country to report Covid-19, so its market was hit earlier than others, but its recovery has also been faster: the market finished 2020 with sales down just 2%. Given its drop a year earlier was 8%, that’s a solid result.

“The virus, the lockdown and the initial panic explain most of the drop everywhere in the world,” says Jato Dynamics analyst Felipe Munoz. “However, we must remember that the global market was already posting declines in the months before Covid-19 arrived.”

The US (-15%), Japan (-12%) and Germany (-19%) experienced double-digit market drops but still suffered less than France and Brazil.

Significantly for the UK, its even steeper decline allowed Brazil to climb into seventh spot – the first time it has done so since 2014.

At least there is evidence of sales recovering into 2021. “Fortunately, we have seen some strong signs of recovery in markets like China and South Korea and some tiny signs in the US, Latin America and India,” says Munoz.

Add your comment