British engineering giant GKN, whose Driveline division is one of the world’s largest automotive suppliers, is set to change ownership after investors backed an £8.1 billion hostile takeover by Melrose Industries.

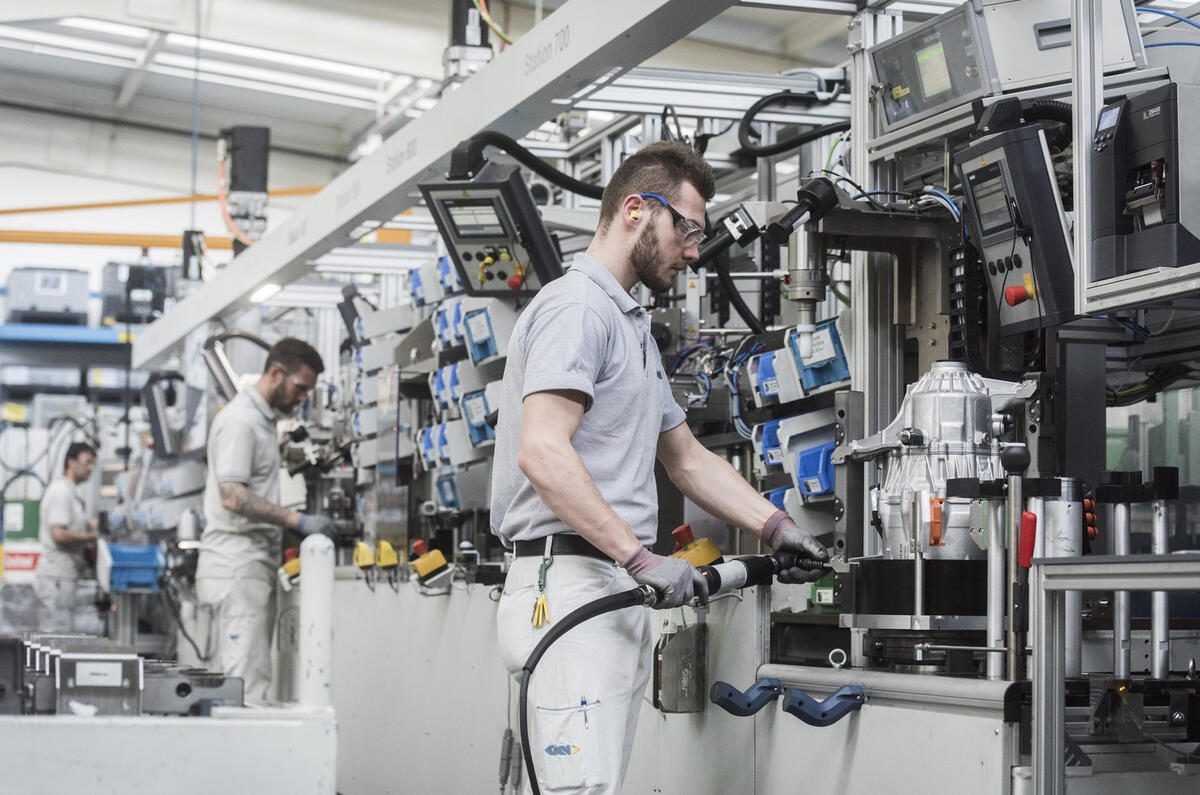

Redditch-based GKN has nearly 60,000 employees worldwide, and its Driveline division produces automotive components for major car firms including BMW, Volkswagen and Volvo. The automotive division generated revenue of £9.7 billion in 2017.

GKN details next-generation lightweight EV powertrain

The future of GKN, which also has major aerospace and freight services divisions, has been in doubt since it issued a string of profit warnings last year and launched a review into its US aerospace arm. GKN bosses developed a restructuring plan that would have involved splitting out Driveline, and merging it with American car components firm Dana to create a new company, which GKN would take a 47% stake in.

At the same time, British-based Melrose Industries, which describes itself as a ‘turnaround specialist’ launched a bid to takeover GKN. Melrose has a strategy of buying manufacturing businesses, and restructuring them, before selling them off within five years.

That has led to fears that GKN could end up in foreign ownership, and that jobs could be at risk, prompting concerns from unions, government and firms that GKN supplies.

GKN: future electric driveline tech will create super-agile EVs

Melrose’s proposed deal was voted on by GKN shareholders earlier today, with 52.43% voting in favour. Melrose chairman Christopher Miller said: "We are delighted and grateful to have received support from GKN shareholders for our plan to create a UK industrial powerhouse.

“We are looking forward to working with GKN's talented workforce and to delivering for customers and all stakeholders. Melrose has made commitments as to investment in research and development, skills and people and we are very excited about putting these into action.”

In the aftermath of the takeover announcement GKN shares rose 5.5%, with Melrose shares up 1.3%.

Read more

GKN details next-generation lightweight EV powertrain

GKN: future electric driveline tech will create super-agile EVs

Join the debate

Add your comment

It's a sad day...

We've always had some of the world's best engineers here in the UK and (thankfully) our motorsport know-how is still much in demand but why oh why are we so incapable of managing our own engineering/vehicle mfg companies.

Too many have gone the same way, asset stripped, broken-up, sold to foreign owners - we've lost iconic British brands such as JLR/RR/Bentley only for their new owners to sell the resulting vehicles back to us but with them (Tata/BMW/VW) pulling the strings and pocketing the proceeds.

I would say lessons need to be learned but the same scenario has been playing out for the past 30 years and here we are now with GKN - it wouldn't happen in another country, so why do we let it?

Turnaround specialist = asset strippers

I'd be very wary of Melrose, I don't think this is in the nest interests of GKN.

Such a shame it's come to this. GKN had some headwinds in North American aero when the US stopped ordering Blackhawk helicopters, and now one of our last large UK domiciled engineering companies is in the hands of an asset stripper.

We've never had a proper joined up industrial strategy in this country, and now with Brexit looming things look really rather hopeless for the long term.

Asset Strippers is right

Your task is almost complete, grasping, money men.