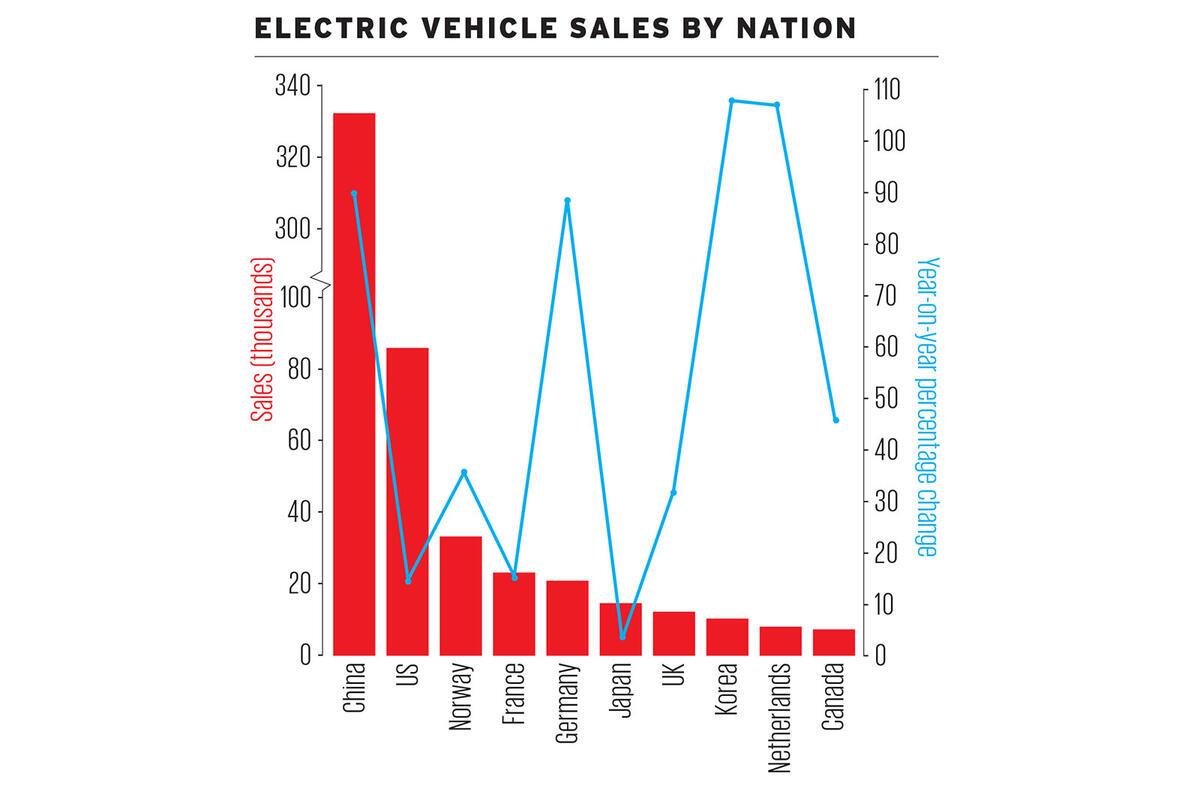

In a world characterised by political uncertainties, the automotive industry provides one global constant – the onward march of China’s new car market.

China overtook the US as the world’s biggest car market in 2010 and last year consolidated that position with 25.7 million cars sold – that’s eight million more than the US. Chinese car buyers are flocking to SUVs and city cars, especially local market electric vehicles; while, at the other end of the affordability scale, demand for luxury models rocketed.

For China, however, last year was actually a modest one, with growth of just 2% compared with 2016, but the contrast with the US was stark. A total of 17.2 million units were sold in the US, 300,000 fewer than in 2016. This was the first time sales have tailed off there since the 2008 recession.

The damage to the US market was wrought in the summer when SUV and pick-up sales dipped.

All of the data featured below comes from automotive industry analyst JATO Dynamics. Most of the figures are actual year-end sales, but in some cases include December forecasts. This is because the final month’s official figures in some markets can take a while to filter through.

Luxury cars boom, sports cars decline:

Demand in China made the luxury car market the biggest-growing segment in the world last year. Cadillac and Lincoln were the major winners, alongside Porsche.

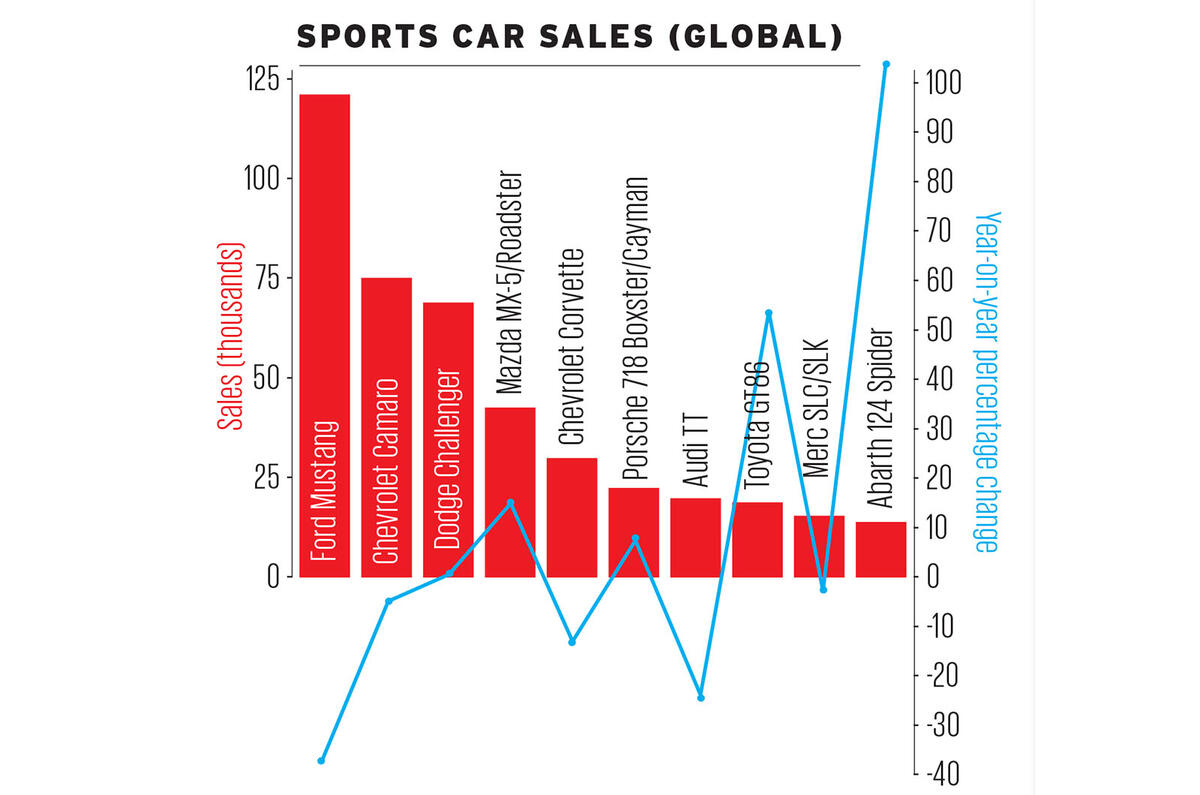

Car enthusiasts won’t be so pleased to see the sports car market take such a hit, but declining demand for the Chevrolet Corvette and Ford Mustang hit the segment hard.

Join the debate

Add your comment

Brexit

quick, how do we blame the drop in USA sales on brexit?

Not Brexit's fault - yet

What might concern you is when the UK, having left the EU and being in a weak position, seeks a free trade deal with the USA and is told that, due to the 'America First' priority, JLR must either build in the USA the 100,000 cars a year that it sells to the USA or face a 20% tariff on them.

It's the people in Sunderland who probably deserve your sympathy as 82% of the cars they build go to the EU and if no free trade deal is struck, production there may no longer be viable. Nissan are looking at Slovakia as a possibility - following the JLR lead...

NavalReserve wrote:

JLR moved to Slovakia because the EU pasid them to move there, in order to damage British manufacturing and reduce available jobs in Britain. They did that nearly a full year before the Brexit vote even took place, so it was nothing to do with a reaction to Brexit, it was pure malice and hatred of Britain. If the EU doesn't want to take Sunderland's cars after Brexit is completed then the British people will buy them and the EU can keep all their VWs, Renaults, Fiats, BMWs, Mercedes, Fords, Citroens and so on. We'll have the Nissans, Toyotas and Hondas built here. I'm sure we'll get used to the improved reliabiity given time.

So taking out China and it's

That is completely feeble.

What sort of tipping point is that?

eseaton wrote:

China's incentives aren't particularly "immense", they're 10% of the car's value. That's actually less of a discount than the Leaf and Zoe get here in Britain. China is a special case for several reasons - EVs are cheaper to build there because it's where most of the battery industry is based, the government sets stricter emissions mandates for manufacturers, there are far more models on sale there than anywhere else (the vast majority by local brands), and the public are more conscious about air pollution because there's visible smog in the cities.

If you take China entirely out of the picture then EVs comprise 0.5% of sales, per the data Autocar cites. Which, yes, is still pretty shit. It will improve as the tech does (the Model S is one of the world's best-selling £70k+ cars regardless of powertrain), but governments and manufacturers probably need to step up their game too.

If only Autocar (and other publications) would...

...take note and only devote 0.3% of their output to EVs. Guess they're finding ICEs boring - let's hope JLR don't release an EV soon - the magazine (and Cropley's garage) will be full of it.

When this SUV madness is past

When this SUV madness is past, future historians will have an interesting time trying to analyse its market dominance, trying to answer why so many people bought something that's heavy, aerodynamically & fuel inefficient, didn't use them for their intended off-road purpose etc. etc.

The rise of the hatchback can easily be justified, because they offer accomodation of a family on a small footprint, with the added versatility of the rear bench convertible into a boot. But SUV?

abkq wrote:

Why should something tagged as an SUV have off road credentials or ability? Perhaps the sport bit is stretching it but the utility vehicle can mean anything.

abkq wrote:

Have a look at a progression of automobile shapes from the 1920s to the 1980s and you will see how seating height for passengers and driver gradually dropped until in the 1980s seats were not far off the road, and cars were relatively low and sleek. Some vehicles resisted this trend. (Look at London cabs for instance. This was the ultimate "city car" - here you'll see a type of transportation where passenger and driver stayed at much the same height from the road for decades.) What we are seeing in faux SUVS is really just a return to where things were, post-war. We traded height for handling; now we're saying give us back the height and we'll accept less handling prowess. I guess if we are going to spend lots of time in our cars, not going anywhere fast, we might as well be comfortable getting in and out of them, and seeing past other traffic and obstacles.